Traders scale back bets to two Bank of England rate cuts this year

Stay knowledgeable with free updates

Simply join to the UK rates of interest myFT Digest — delivered straight to your inbox.

Traders are pricing in two quarter-point curiosity rate cuts from the Bank of England this year, as policymaker Megan Greene stated such strikes “should still be a way off”.

International markets have scaled back their expectations of imminent rate cuts within the US and the eurozone in latest weeks. The European Central Bank is assembly on Thursday however is anticipated to hold charges at their all-time excessive.

Traders are now not absolutely pricing within the first UK curiosity rate reduce in August and now anticipate borrowing prices to start to fall in both that month or September.

The two cuts they now anticipate for this year — one during which Prime Minister Rishi Sunak is hoping to ship an election-winning financial turnaround — distinction with the greater than six cuts markets anticipated in January.

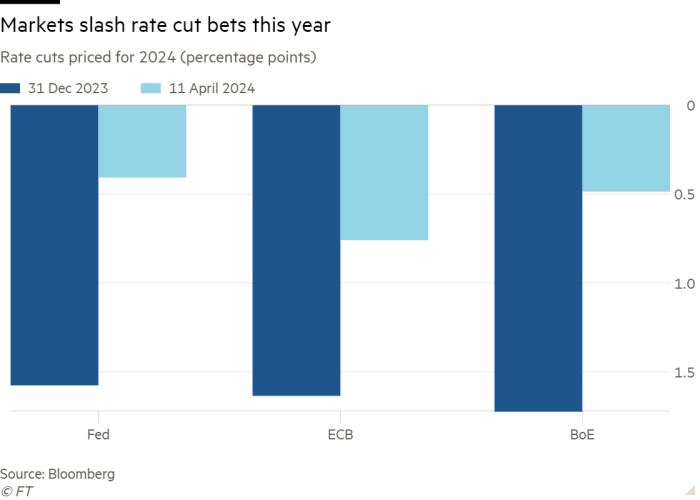

On Thursday the curiosity rate swaps market absolutely priced in a cumulative reduce by year finish of round 0.5 proportion factors.

Market expectations have shifted in comparable vogue within the US and the eurozone, with merchants in each areas slashing the quantity of curiosity rate cuts they anticipate this year by not less than half.

But Greene, one of the extra hawkish members of the BoE’s financial coverage committee, argued within the Financial Times on Thursday that buyers had underestimated the danger that inflation would stay excessive for longer in Britain than in different superior economies.

She additionally questioned market pricing that instructed the UK’s central financial institution would reduce charges earlier and by greater than the US Federal Reserve this year.

“The UK economy has faced the double whammy of a very tight labour market and a terms of trade shock from energy prices,” Greene wrote. “Inflation persistence is therefore a greater threat for it than the US.”

“In my view, rate cuts in the UK should still be a way off,” she added.

Rate reduce expectations have been dented on either side of the Atlantic by unexpectedly excessive US inflation information on Wednesday that marked the second consecutive month-to-month rise.

The shifting expectations within the US, the place President Joe Biden has conceded there may be “more to do” to struggle value rises, are additionally shaping coverage internationally.

Regions such because the eurozone and the UK are doubtless to need to restrict divergence in rates of interest, partly out of worry of weakening their currencies and so additional stoking inflation.

In the UK, Greene has taken a extra hawkish view than the bulk of the nine-member MPC on a number of events since she joined the committee final August. Last month, nevertheless, she voted with most of the members to depart the BoE’s benchmark rate at a 16-year excessive of 5.25 per cent.

Her feedback echo these of Jonathan Haskel, one other MPC hawk, who cautioned in a latest interview with the FT that curiosity rate cuts needs to be “a long way off” as a result of a near-term fall in headline inflation wouldn’t be a dependable information to “persistent and underlying” inflationary pressures.

UK shopper value inflation fell to 3.4 per cent in February, its lowest degree since 2021, and large declines in family vitality payments will drag it down additional within the close to time period.

But the BoE’s newest forecasts counsel this drop will likely be short-term, with home value pressures pushing headline CPI back above the central financial institution’s 2 per cent goal for a lot of the following two to three years.

Both Haskel and Greene argue that UK wage development and companies inflation stay too excessive for consolation, regardless of latest indicators that pressures within the labour market are lastly easing.

However, different BoE rate-setters have provided a extra upbeat view.

Andrew Bailey, the central financial institution governor, advised the FT final month that rate cuts have been “in play” at future MPC conferences. He stated the committee mustn’t look ahead to annual development in wages and companies costs to halve earlier than it was prepared to ease coverage.

Additional reporting by Mary McDougall