Examining the odds of XRP hiking by 50% to re-test its March levels again

- XRP’s value appreciated by greater than 10% in the final 24 hours

- Metrics revealed that purchasing stress on the token was excessive

XRP‘s efficiency over the final 24 hours has been exceptional, with its worth surging by double digits. In reality, the newest value push allowed the token to break above a essential resistance stage, one which might lead to an additional value hike in the coming days.

Hence, it’s price taking a look at whether or not metrics supported the case for a sustained bull run.

XRP is pumping

World Of Charts, a well-liked crypto analyst, just lately shared a tweet highlighting an attention-grabbing growth. According to the identical, a bullish falling wedge sample appeared on the token’s value chart. The token has been consolidating inside the sample after reaching its March heights.

XRP’s value hiked by greater than 18% in the final seven days. In the final 24 hours alone, the token’s worth surged by over 10%. At the time of writing, XRP was buying and selling at $0.5144 with a market capitalization of over $28 billion, making it the seventh largest crypto.

Thanks to the aforementioned value motion, the token managed to break above this bullish sample. If the token continues to take a look at the sample, then traders would possibly see an increase of greater than 50% in XRP’s worth in the coming days.

What do the metrics say?

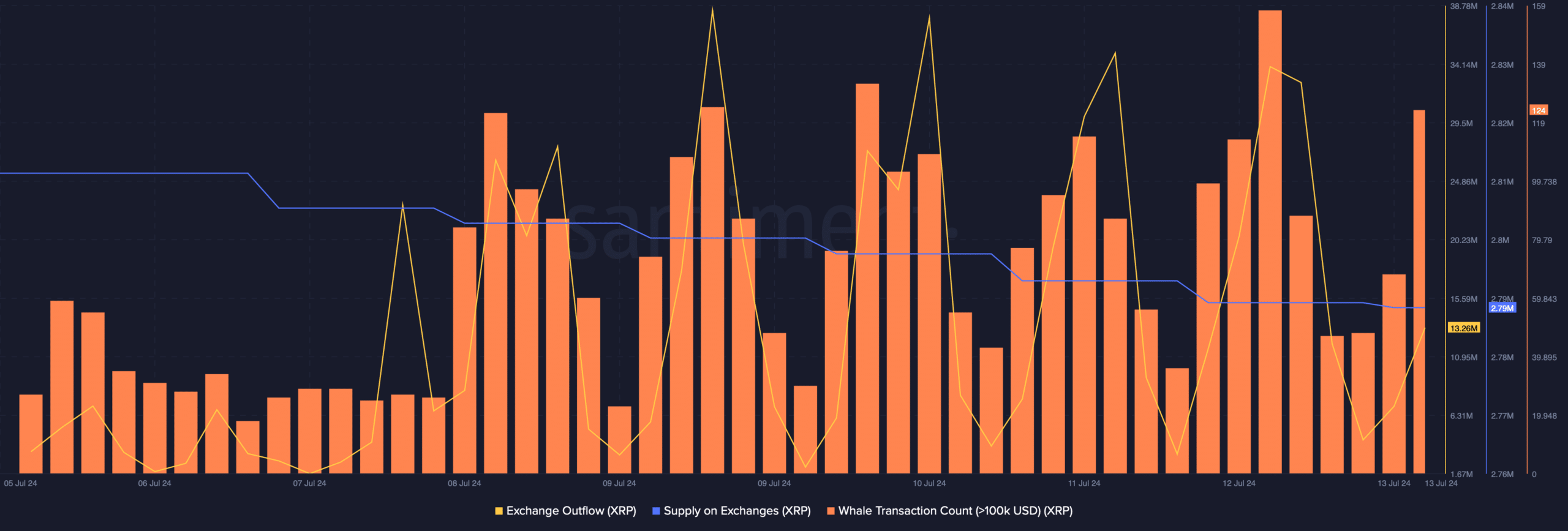

AMBCrypto’s evaluation of Santiment’s information revealed that purchasing stress on the token has been excessive. This appeared to be the case, as its trade outflows spiked sharply too.

The reality that purchasing stress on XRP was excessive was additional confirmed by the decline in its provide on exchanges, that means that traders are actually accumulating extra tokens. Whale exercise round XRP was additionally excessive – Evidenced by the hike in its whale transaction depend.

Source: Santiment

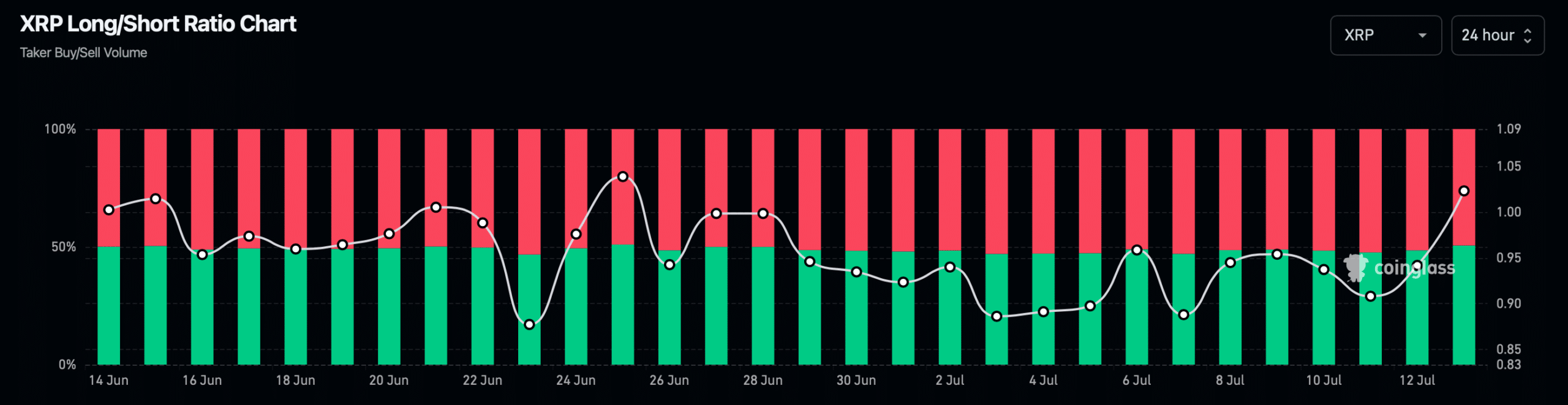

A have a look at Coinglass’ data additionally revealed that the token’s Open Interest hiked, together with its value. Generally, an uptick in the metric means that probabilities of the ongoing value development persevering with are excessive.

Additionally, its lengthy/quick ratio additionally rose. Simply put, there are actually extra lengthy positions in the market than quick positions – An indication of excessive bullish sentiment.

Source: Coinglass

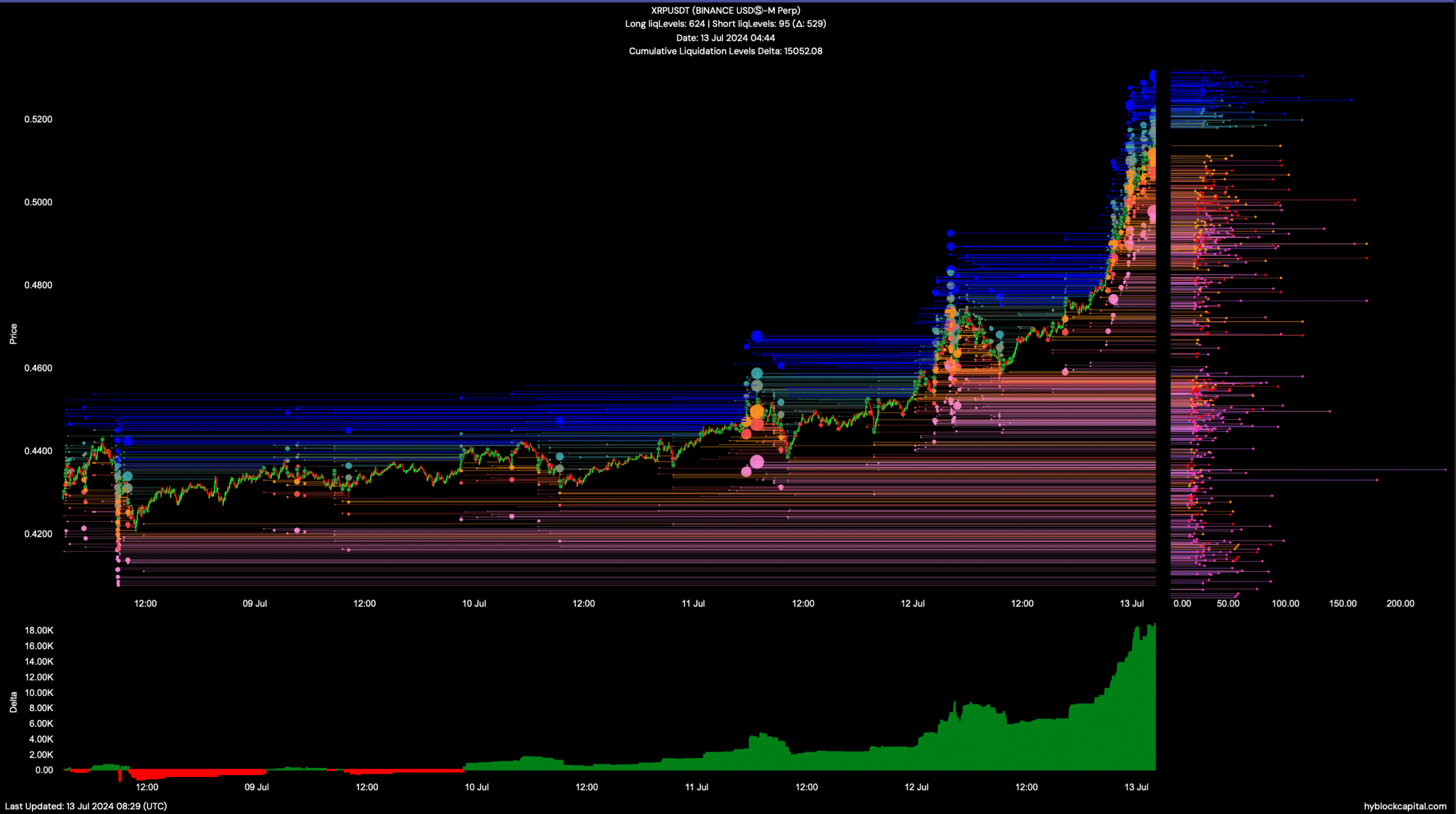

On the opposite, a have a look at Hyblock Capital’s information revealed that XRP’s cumulative liquidation stage delta hiked considerably.

Such an enormous uptick would possibly trace at a potential market high, one which may be adopted by a value correction on the charts quickly.

Source: Hyblock Capital

Realistic or not, right here’s XRP’s market cap in BTC’s phrases

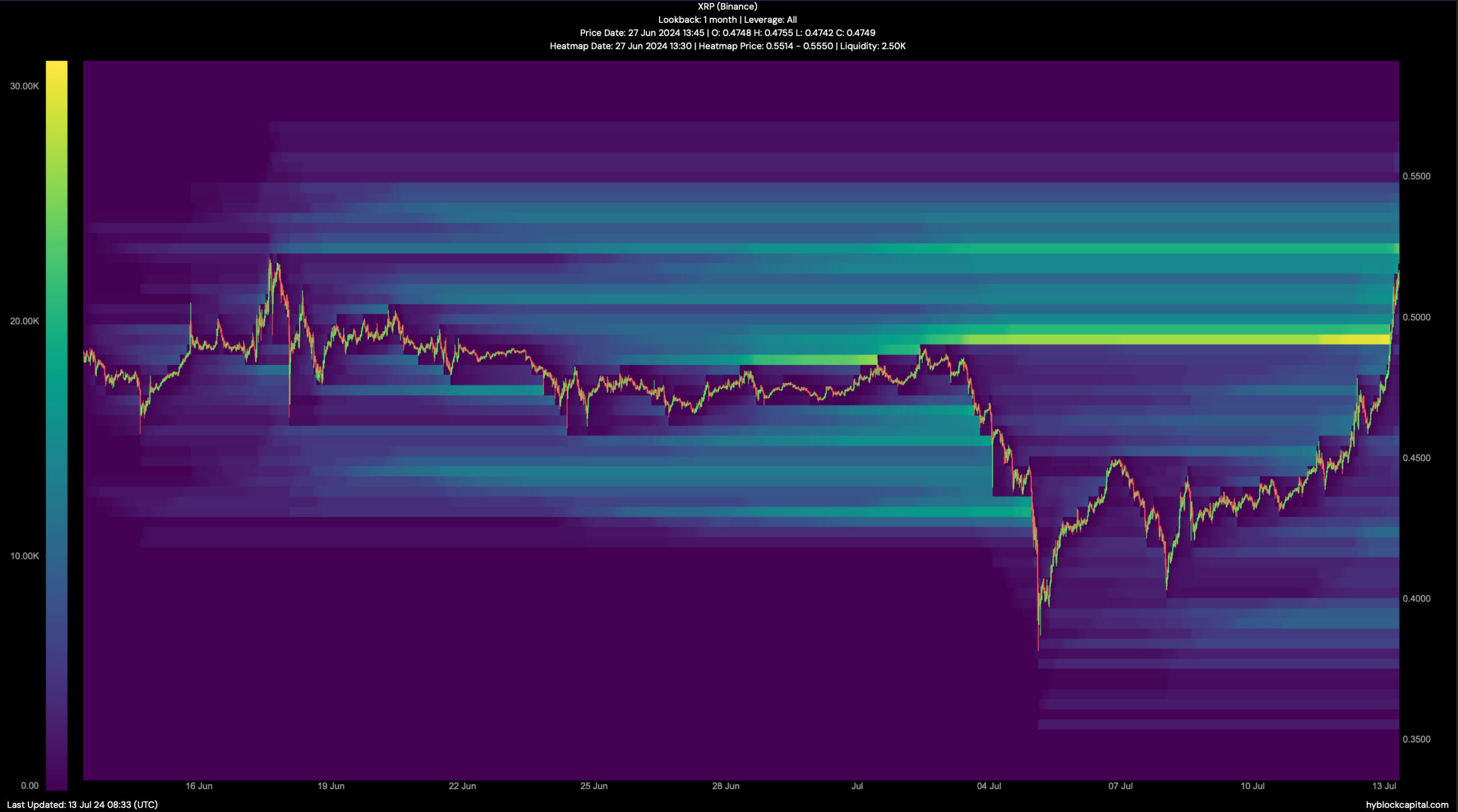

Finally, AMBCrypto checked the token’s liquidation heatmap to search for potential help and resistance zones for the token. We discovered that the token’s liquidation would rise to close to $0.526.

An increase in liquidations typically ends in value corrections. However, if the bears take over the market, then the token’s value would possibly drop to $0.42.

Source: Hyblock Capital