Ethereum echoes Bitcoin’s post-ETF pattern: Will ETH rally 90%?

- ETH may rally 90% to $6.5k if it follows Bitcoin’s post-ETF development.

- ETH demand from U.S. buyers was nonetheless low to shift market sentiment.

Ethereum [ETH] dropped from $3.5k to $3k two days after U.S. spot ETH ETF launched, about an 8% decline. It was barely up above $3.2k as of press time.

However, a market observer, Croissant, claimed that ETH’s value motion post-ETF launch echoed Bitcoin’s [BTC] sample after U.S. spot BTC ETFs went stay in January.

If the correlation persists, ETH may drop to $2.7k in two weeks earlier than rallying 90%, in line with the analyst.

“Ethereum is following the exact same trajectory as Bitcoin after the ETF was approved. -8% ($3143) two days after approval <we are here>, -20% ($2749) two weeks after approval, +90% ($6547) two months after approval.”

Source: X/Croissant

It meant that ETH may hit $6.5k by September. That’s an over 90% rally in two months.

For perspective, BTC dropped from $48ok to $40ok after the BTC ETF was launched. Two months later, the biggest digital asset exploded to $73Okay in March.

Another famend analyst, Crypto Kaleo, agreed with the projection.

Can ETH soar 90% and hit $6.5k in two months?

However, it’s price noting that correlation doesn’t all the time equal causation. Put in a different way, ETH mirroring the BTC sample post-ETF doesn’t essentially imply the result could possibly be the identical.

That stated, as most analysts have predicted, ETH may benefit from anticipated Fed price cuts in September. This may enhance all threat belongings, together with crypto.

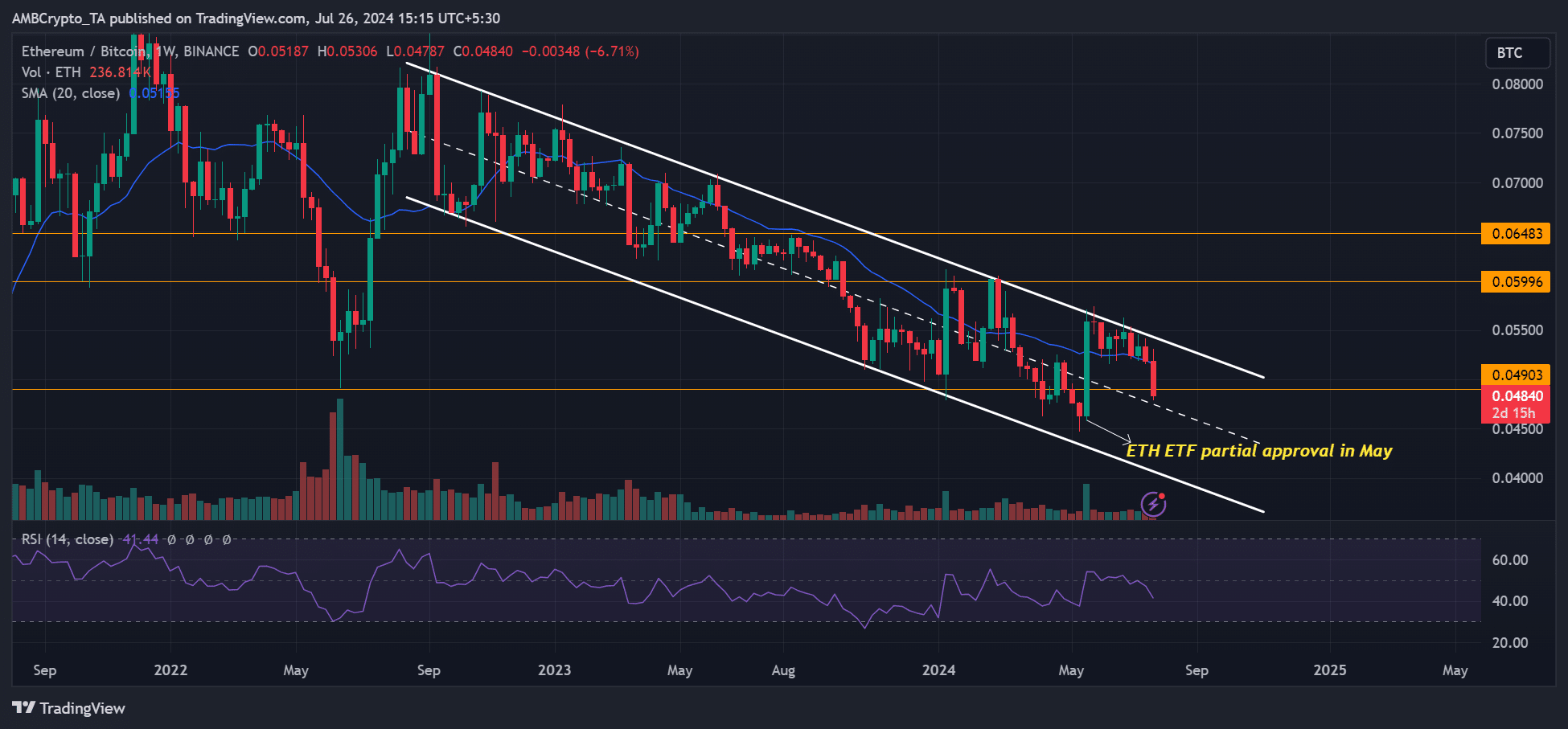

Meanwhile, ETH has been underperforming BTC in its spot ETF debut week, as proven by the ETHBTC ratio declining over 6% on a weekly adjusted foundation as of press time.

Source: ETH/BTC, TradingView

A drop under the mid-range stage, close to 0.045, may weaken ETH even additional relative to BTC.

In truth, in line with Andrew Kang of Mechanism Capital, there was a high risk of ETHBTC dropping to 0.04 or under, which might make it unattractive as a hedge.

“At that point (below 0.04 ETHBTC), I don’t believe $ETH will be as interesting of a hedge anymore.”

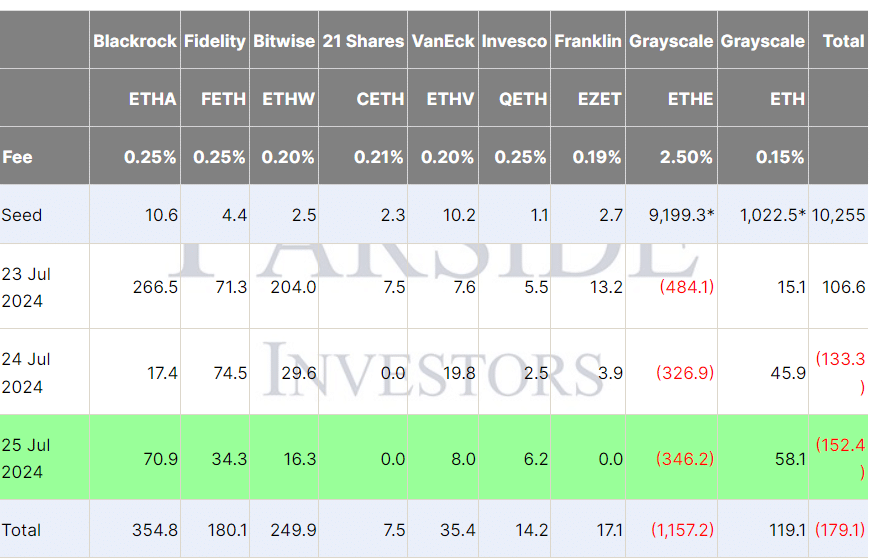

The threat Kang referred to was the U.S. spot ETH ETFs’ net outflows up to now two days. The merchandise noticed $133 million and $152 million outflows on the 24th and 25th of July, single-handedly pushed by Grayscale’s ETHE bleedout.

Source: Fairside Investors

However, Daniel Yan of Kryptanium Capital was hopeful that the 0.045 stage would ease the ETHBTC decline. The jury remains to be out on whether or not the ETHBTC will drop additional.

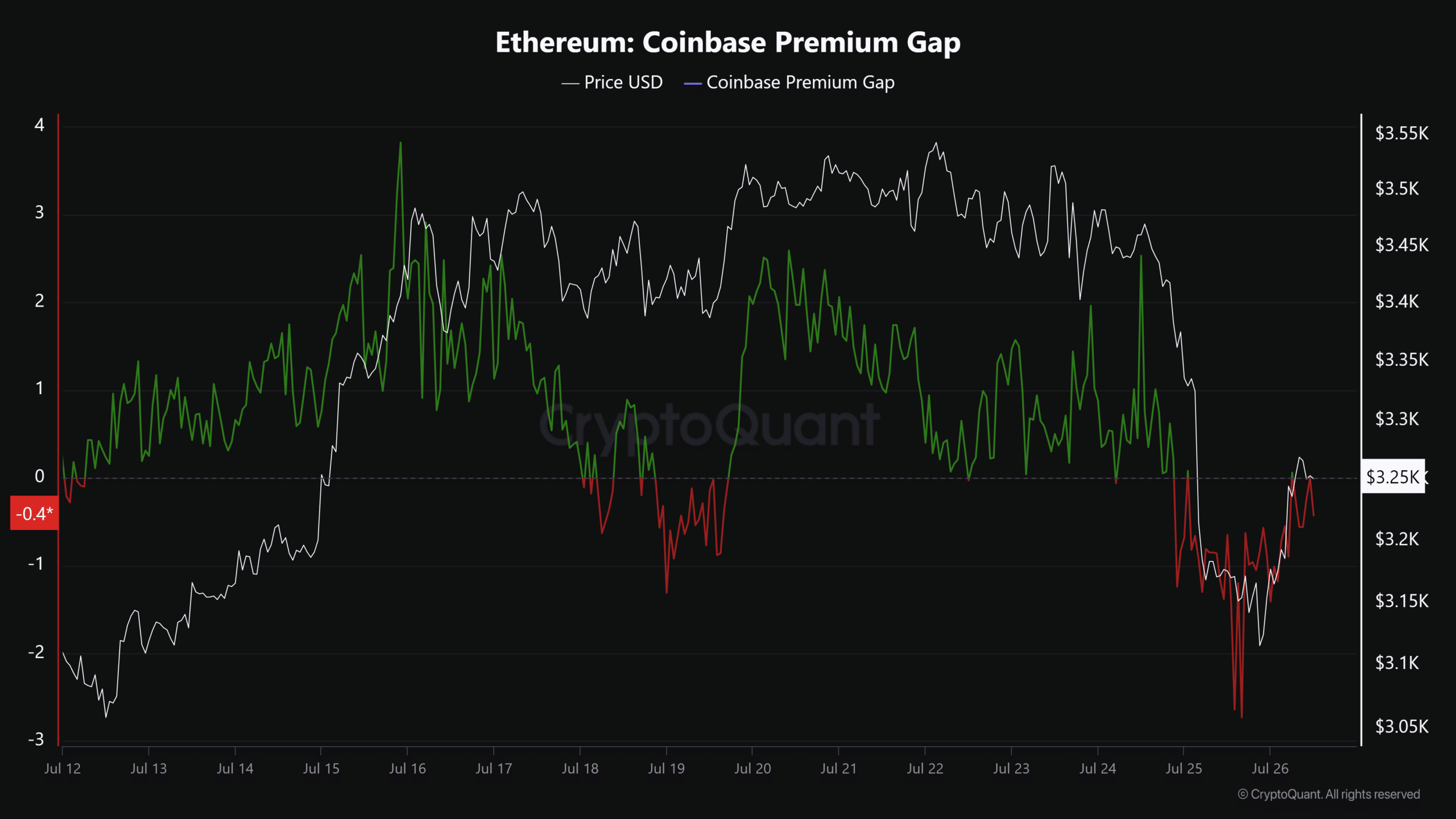

In the meantime, in line with CryptoQuant head of analysis, JA Maartunn, a convincingly bullish reversal for ETH may occur when a robust demand comes from U.S. buyers.

As of press time, U.S. demand was nonetheless low, as denoted by the low Coinbase Premium Gap.

Source: CryptoQuant