Are Ethereum ETFs imminent following Bitwise’s early S-1?

- Bitwise submits the Ethereum ETF submitting early, suggesting a mid-July launch.

- Ethereum value drops however ETH holders are bullish with the potential for value surge.

In the newest replace on the potential approval of a spot Ethereum [ETH] ETF, Bitwise, an asset supervisor, has taken proactive steps by submitting an amended S-1 form forward of schedule.

Bitwise transfer amidst surprising delays

Initially anticipated to launch round 2nd July, as per Bloomberg’s Senior Analyst Eric Balchunas, the timeline for ETH ETFs has since been adjusted to eighth July following the SEC’s new deadline for companies to amend their S-1 submissions.

For context, this delay originated from the SEC’s request on 28th May for issuers to handle minor queries of their S-1 filings.

Remarking on the identical, Bloomberg ETF analyst James Seyffart stated,

“We’ve got another amended S-1 from @BitwiseInvest for their #Ethereum ETF. Expect more from other issuers throughout the rest of the week. We’re thinking these things could potentially list later next week or the week of the 15th at this point.”

Adding to the fray was Nate Geraci, president of ETF Store, who not too long ago expressed his optimism concerning the ETF’s approval, suggesting that the SEC might grant last approval by 12th July, paving the best way for buying and selling to begin by 15th July.

The delay was not required

This has induced important confusion inside the business relating to the ultimate approval date. However, Bitwise’s early submitting of the amended S-1 types on third July means that the merchandise are nearing launch.

Providing additional insights on the matter, Balchunas famous,

“Prob just wanted to get it off their plate and from what I hear the last round of comments were ‘literally nothing’ = took zero time to update. Also, no fee yet. Prob get those next week-ish.”

This has sparked criticism in the direction of SEC Chair Gary Gensler. Many additionally argue that it’s time for a change in SEC management. Echoing these sentiments was X person Circuit, who claimed,

“This is just Garry throwing this weight around one last time before he is out the door.”

Impact on ETH: Should you be involved?

Unfortunately, regardless of Bitwise’s efforts to hurry up the ETH ETF course of, Ethereum’s value took successful. According to CoinMarketCap, ETH dropped by 5.09%, buying and selling at $3,189.50.

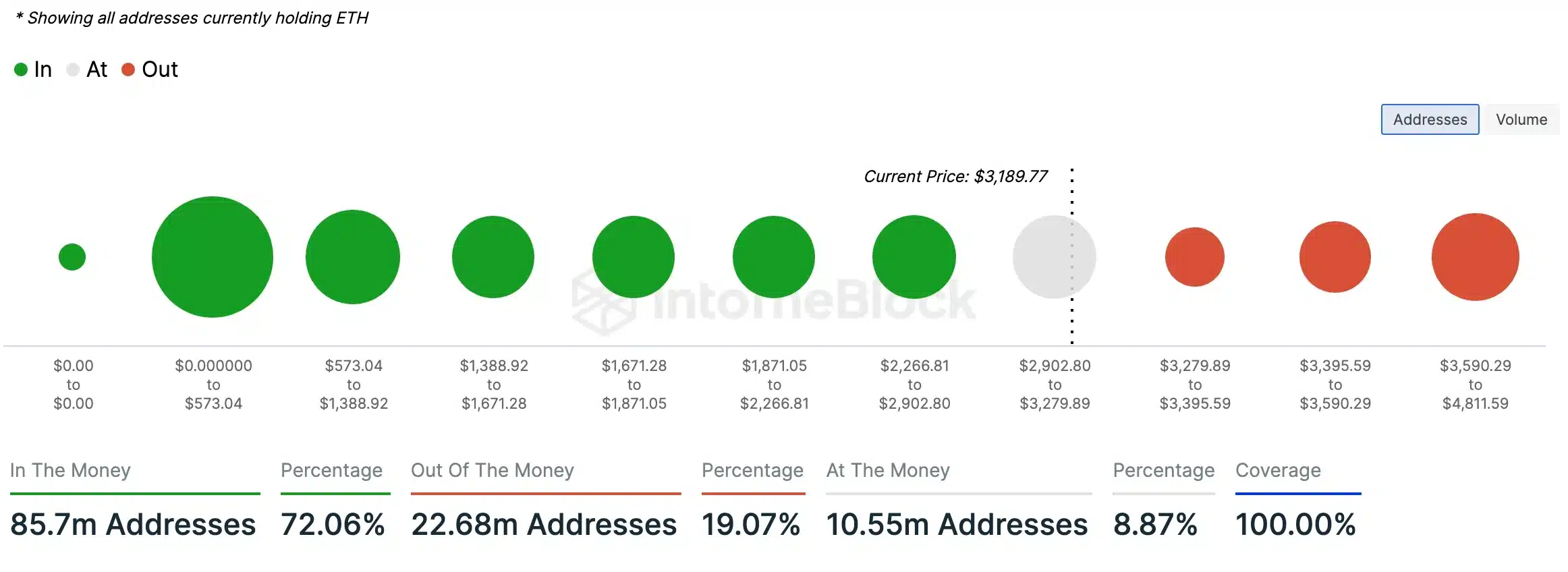

However, AMBCrypto’s evaluation of IntoTheBlock knowledge reveals {that a} important majority (72.06%) of ETH holders at the moment maintain tokens valued increased than their buy value, indicating they’re “in the money.”

In distinction, a smaller phase (19.07%) holds ETH tokens which are price lower than their buy value, inserting them “out of the money.” This suggests a bullish sentiment or potential upcoming value surge for Ethereum.

Source: IntoTheBlock