Bitcoin: Buying opportunity opens up – Does this indicate a BTC rally?

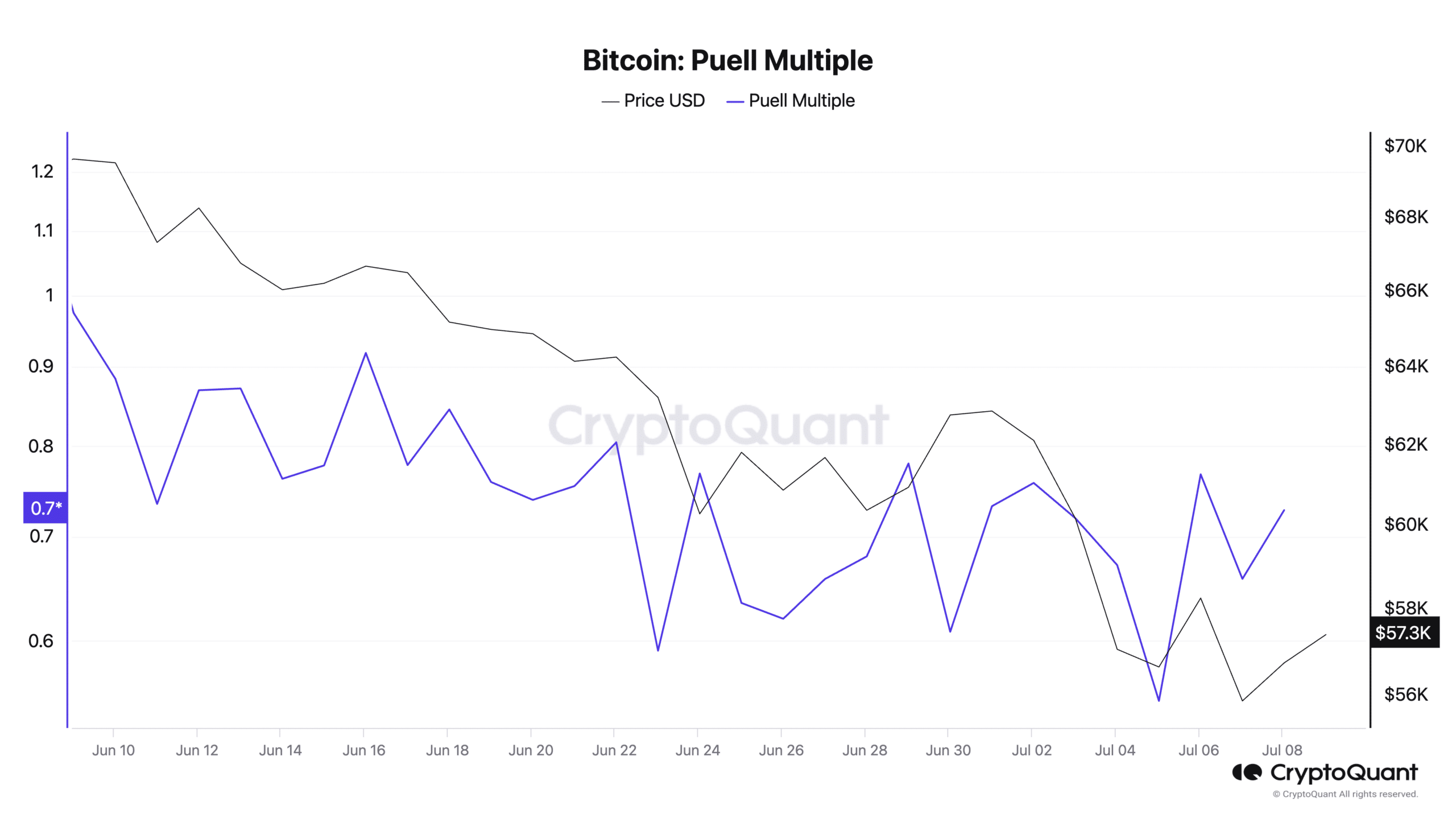

- Bitcoin’s Puell Multiple has been on a decline within the final month.

- This offered a shopping for opportunity for market individuals.

The latest decline in Bitcoin’s [BTC] Puell Multiple hinted at the potential for a new bull cycle, pseudonymous CryptoQuant analyst Crypto Dan present in a new report.

BTC’s Puell Multiple tracks the revenue miners on the community make by evaluating BTC’s every day issuance worth to its 365-day shifting common.

When BTC’s Puell Multiple surges, it signifies that the coin’s every day issuance is considerably above the yearly common. This typically corresponds with market peaks and indicators that BTC is overvalued and due for a decline.

Conversely, when this metric declines, it means that the every day issuance worth is beneath the yearly common, indicating potential BTC undervaluation.

It is commonly adopted by a BTC worth spike as market individuals “buy the dip.”

As of this writing, BTC’s Puell Multiple was 0.80. It initiated its present cycle of decline on the sixth of June and has since fallen by 54%.

Source: CryptoQuant

Dan assessed BTC’s historic efficiency and located that when its Puell Multiple plunged in the course of the bull cycle in 2016 and 2020, it was “followed by the beginning of Bitcoin’s strong rise.”

According to Dan, this can occur within the present market cycle.

“In 2024 Currently, similar movements have been detected. Although the exact end of the adjustment period is difficult to be certain, it can be expected that it is not far away. It is likely that we will see the start of a bull rally within the 3rd quarter of 2024,” Dan famous.

What are BTC miners up to?

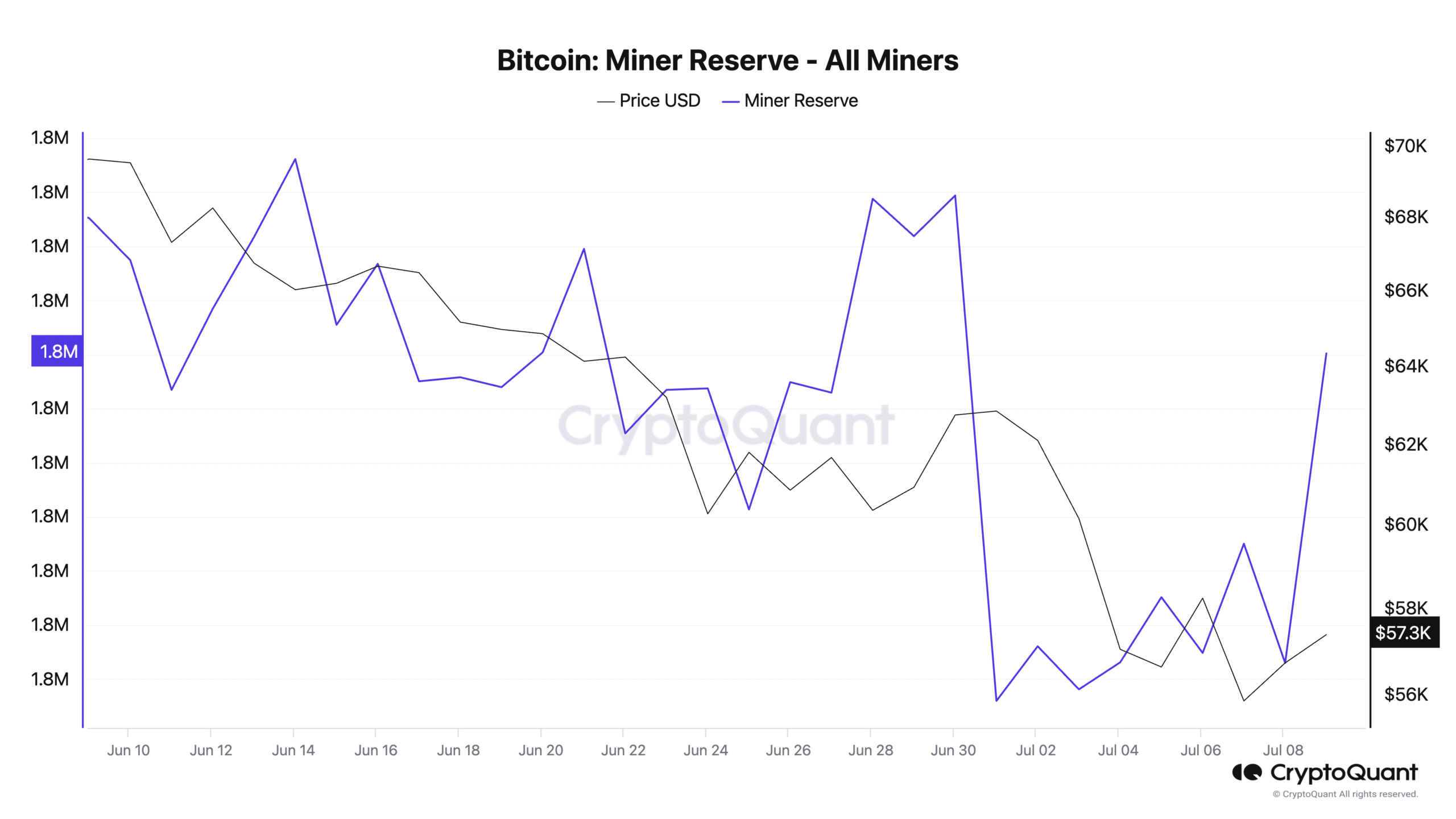

The previous 24 hours have been marked by a surge in BTC’s miner reserves. This metric measures the quantity of cash held in affiliated miners’ wallets. Its worth signifies the reserve that miners have but to promote.

At press time, 1.82 million BTC, valued at $104 billion at press time market costs, have been held throughout miner wallets.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

In the final 24 hours, the BTC miner reserve has spiked by 1%. When this will increase, it signifies that miners are holding onto their cash as an alternative of promoting them available on the market.

Source: CryptoQuant

It could also be because of the anticipation that the coin’s worth will rise within the quick/mid-time period.