Cardano: 309 $1M transactions in 24 hours! ADA to surge?

- ADA’s whale exercise jumped on fifth June.

- This brought about a short uptick in the altcoin’s value.

Cardano [ADA] noticed a spike in whale exercise, ensuing in a short surge in its value through the intraday buying and selling session on fifth June, in accordance to Santiment’s knowledge.

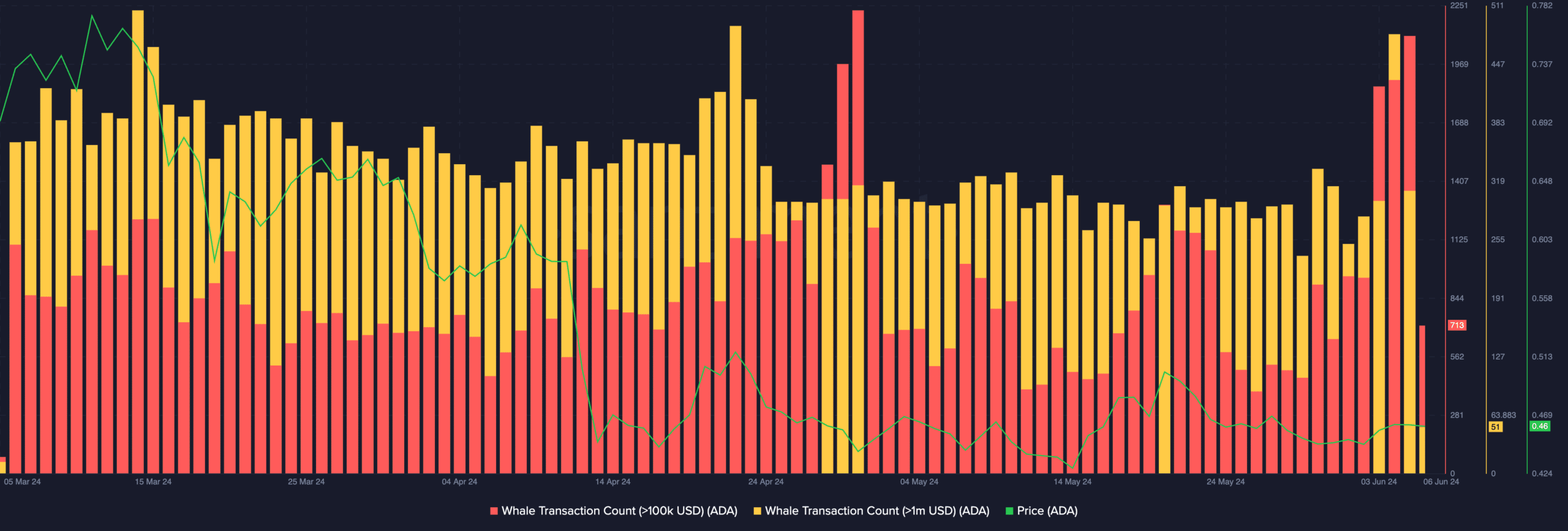

According to the on-chain knowledge supplier, the variety of ADA transactions valued above $1 million totaled 309 on that day. This represented the altcoin’s single-day highest depend since 30th April.

Also, ADA recorded 2106 transactions price greater than $100,000 on the identical day. Data from Santiment confirmed that the variety of ADA transactions valued above $100,000 had doubled this week in contrast to the standard 2024 averages.

Source: Santiment

ADA bears proceed to dominate the market

The surge in ADA whale exercise led to a short rise in its value through the buying and selling interval. Per Santiment, ADA closed the day at $0.46.

However, in accordance to CoinMarketCap knowledge, the coin has since shed a few of these positive aspects. It exchanged arms at $0.45 at press time.

An evaluation of the altcoin’s key momentum indicators confirmed that ADA’s promoting strain outweighs any bullish bias towards it. For instance, its Relative Strength Index (RSI) and its Money Flow Index (MFI) have been 48.32 and 47.29, respectively on the time of writing.

At these values, these indicators advised that market members most popular to promote their cash moderately than accumulate new ones.

Further, ADA’s declining Chaikin Money Flow (CMF) confirmed the uptick in promoting strain. At press time, it trended downward and was positioned under the zero line at -0.07.

This indicator tracks how cash flows into and out of the coin’s market. When its worth is unfavourable, it’s a signal of market weak spot, because it alerts capital flight from an asset’s market.

While the whales might have efficiently triggered a short rally in ADA’s value, the bears proceed to exert extra affect.

Readings from the altcoin’s Directional Movement Index (DMI) confirmed its constructive directional index (inexperienced) resting under its unfavourable index.

When these traces are organized this fashion, bear energy outweighs bull energy in the market.

Source: ADA/USDT, TradingView

Despite the low chance of any important value spike in the brief time period, ADA futures merchants have maintained a bullish outlook. The coin’s funding fee throughout cryptocurrency exchanges has remained constructive.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2023-24

Funding charges are used in perpetual futures contracts to make sure the contract value stays shut to the spot value.

When an asset’s futures funding fee is constructive, it’s a bullish sign. It suggests that there’s extra demand for lengthy positions, as extra merchants are shopping for the asset with the expectation that its value will climb.