ETH to outshine BTC after spot ETF launch

- Market traits favor Ethereum as ETF launch nears.

- The report confirmed a altering panorama in spot buying and selling quantity, choices, Futures, and perpetual contracts.

Cryptocurrency markets have skilled excessive volatility during the last two months. Market preferences are shifting, particularly for the reason that SEC accredited Ethereum [ETH] spot ETFs in May.

With the anticipated launch of ETH spot ETFs, traders are getting more and more optimistic.

Although ETH ETFs have but to begin buying and selling, a report by Kaiko and a joint report from Block Scholes and Bybit confirmed altering market preferences.

A change in traits

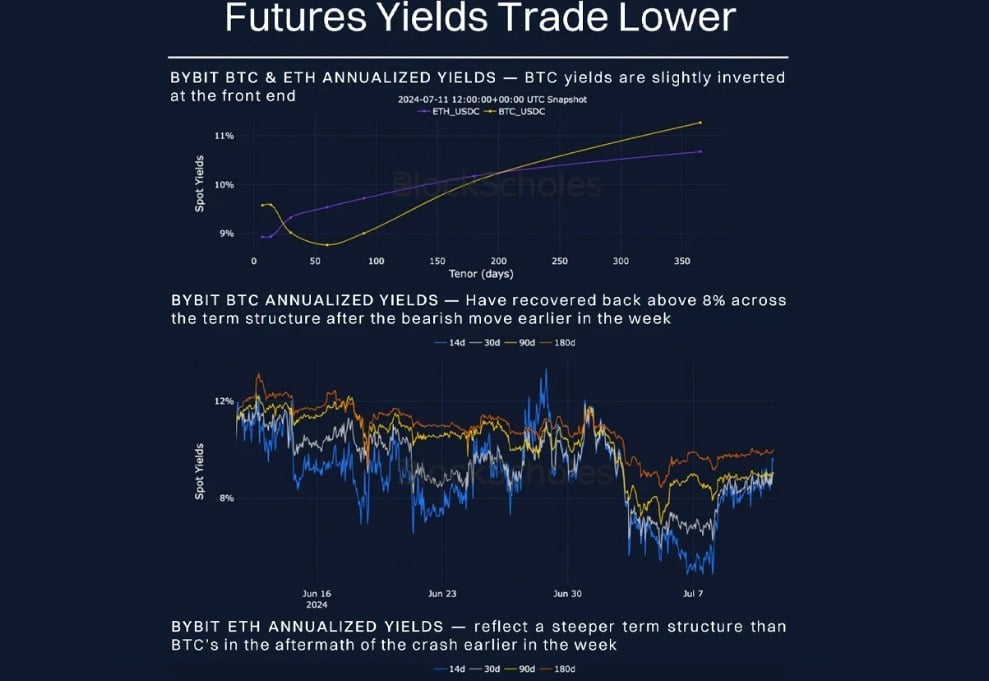

According to the not too long ago launched report by Block Scholes and Bybit, there was a large panorama shift in spot buying and selling volumes, futures, choices, and perpetual contracts.

The report posited that Ethereum loved a greater volatility premium over Bitcoin [BTC]. This primarily arose from elevated deal with exercise and a optimistic market sentiment shift in direction of ETH.

Source: Blockscholes & Bybit

Ethereum positive aspects floor over Bitcoin

The ETH to BTC ratio has sustained a optimistic worth of 0.05 for the reason that approval of spot ETFs. This ratio is significantly increased than pre-approval ranges of round 0.045.

The increased ratio exhibits that when the ETH spot ETFs begin to commerce, it’ll proceed to outperform BTC.

Source: Kaiko

Overall market sentiment

ETH has gained greater than BTC in a number of areas for the reason that approval of ETH spot ETFs in May.

Although the crypto market has skilled excessive volatility over the previous two months, ETH Futures have proven extra resilience and faster restoration than Bitcoin’s Open Interest.

ETH’s sooner restoration for its future prompt a rising optimistic sentiment, with many traders assured in its future.

Source: Blockscholes & Bybit

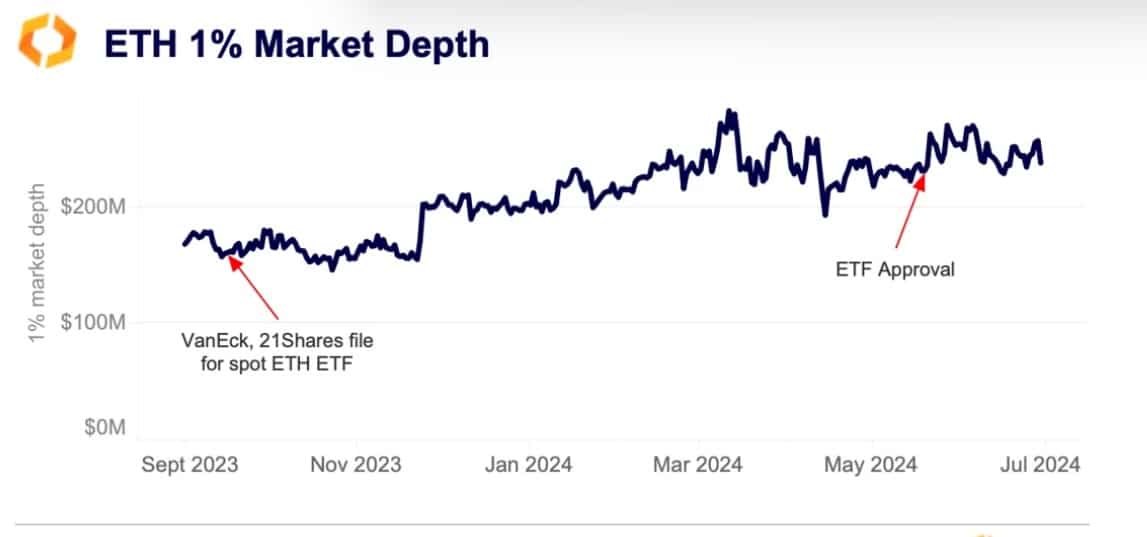

ETH’s buying and selling quantity has been sustained throughout the similar vary since May. According to Kaiko, ETH’s liquidity has been sustained with 1% depth and a constant vary of $250M.

The ETF approval appears to have modified the pattern after dipping under $200M and reversed the pattern after SEC’s approval. Therefore, the ETF anticipation has performed a crucial position in bettering liquidity.

Source:Kaiko

Additionally, ETH perpetual contracts have skilled elevated buying and selling quantity. The enhance confirmed that traders have been keen to pay a premium to maintain lengthy positions, which confirmed confidence in crypto’s future potential.

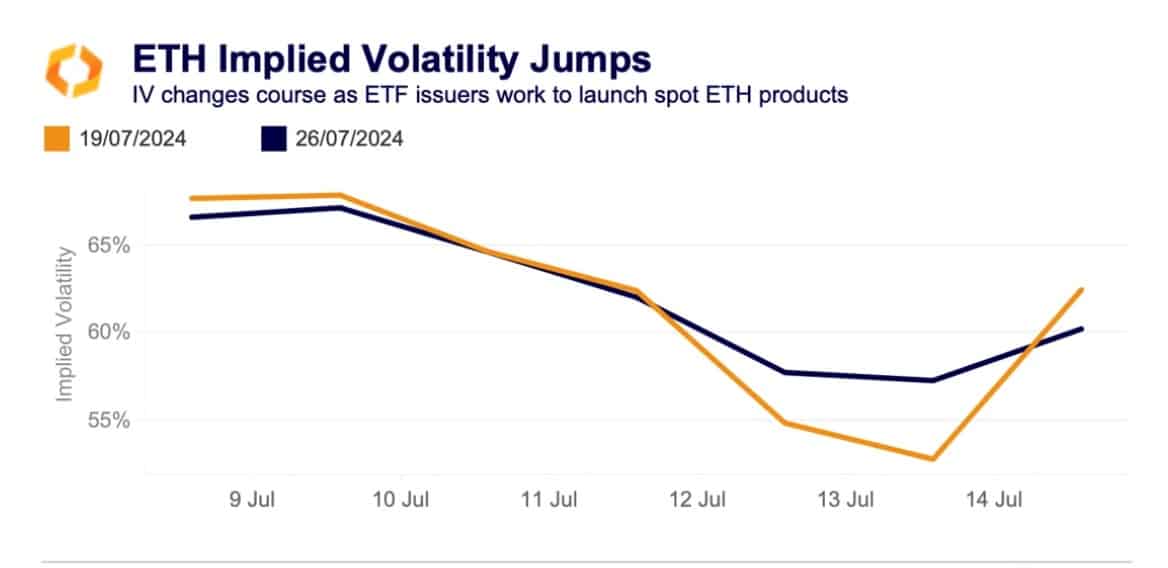

As reported by Kaiko, Implied Volatility surged over the previous seven days. For occasion, ETH choices set to expire this Friday surged from 53% on the 13th of July to 62% at press time.

Read Ethereum’s [ETH] Price Prediction 2024-25

The surge in these contracts implied that traders have been paying brief positions to shield themselves in opposition to value hikes within the brief run.

This market sentiment exhibits appreciable optimism over ETH’s future, particularly with upcoming ETFs this week.

Source: Kaiko