Ethereum Classic’s 2024 – Here’s what you should expect from its price

- Ethereum Classic (ETC) flashed a common downtrend with reducing price highs and lows, coupled with diminishing buying and selling volumes

- A bearish ‘death cross’ prompt a possible lengthy-time period downtrend

Ethereum Classic (ETC) has been a staple within the cryptocurrency market, however by no means anticipated to go 100x. Still, 2024 is broadly anticipated to be a really bullish 12 months for the market, much more so than it has already been. However, issues have slowed down lately, and markets have tumbled.

So, what about ETC? What’s its destiny for the remainder of the 12 months?

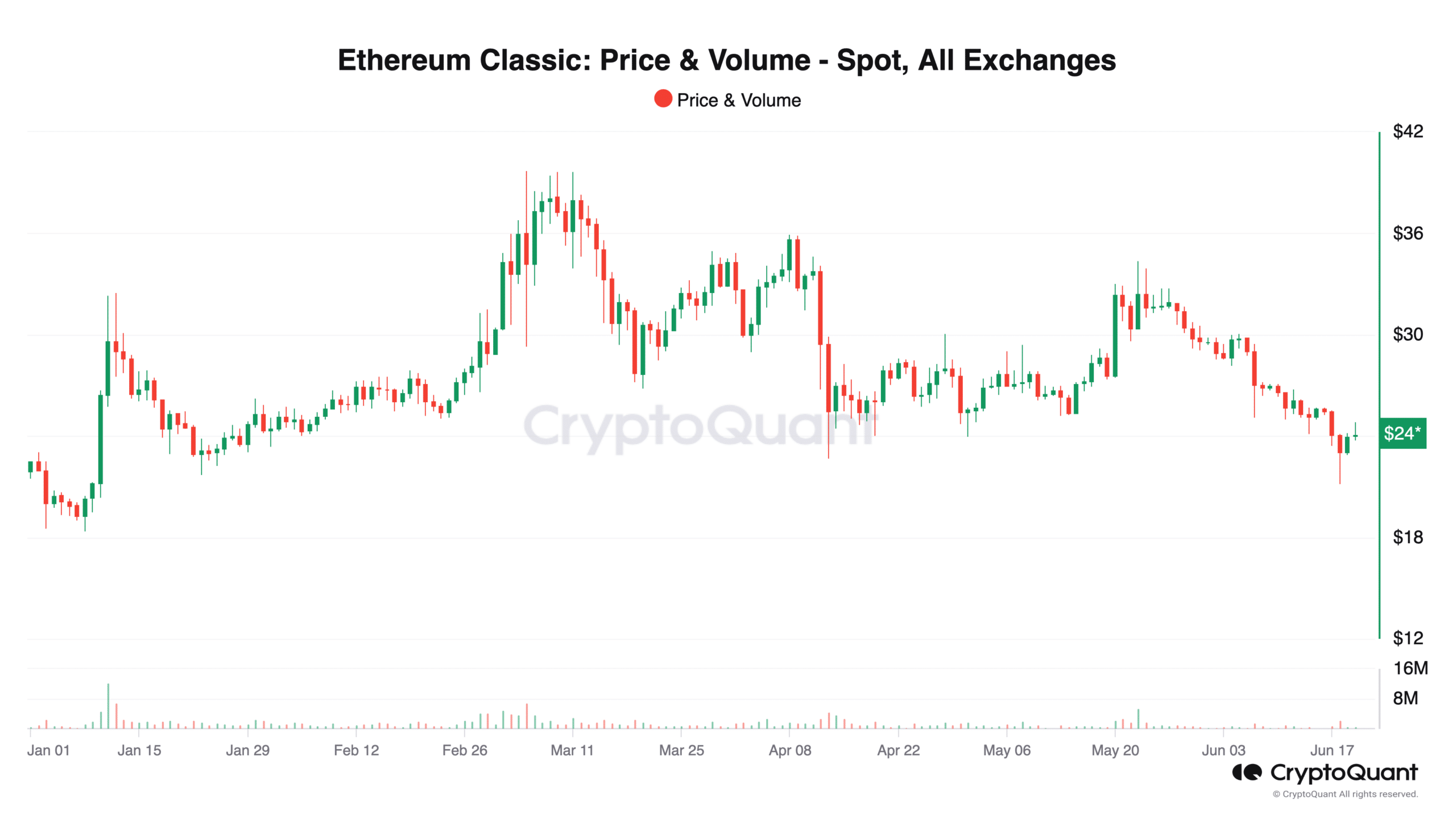

Source: CryptoQuant

Since late May and into June, the development has appeared typically bearish as ETC’s price made decrease highs and decrease lows – A traditional indication of a downtrend. This latest decline in price may be coupled with diminishing buying and selling quantity – An indication of a discount in investor curiosity and market fatigue.

Typically, low quantity throughout a downtrend may counsel an absence of conviction within the promote-offs, however it may additionally imply that fewer consumers are current to push the price again up.

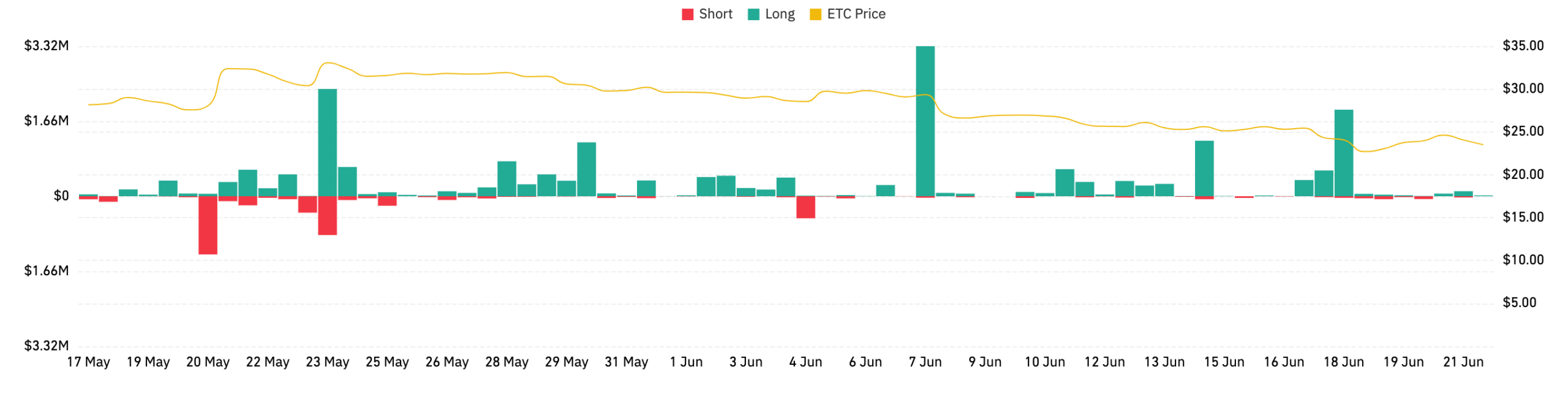

Source: Coinglass

A hike of +5.56% means heightened buying and selling exercise in ETC derivatives, which may be speculative shopping for or promoting. In reality, the notable spike appeared to align with a peak in ETC’s price line, presumably pointing to a speculative rush that was not sustained and led to price retraction.

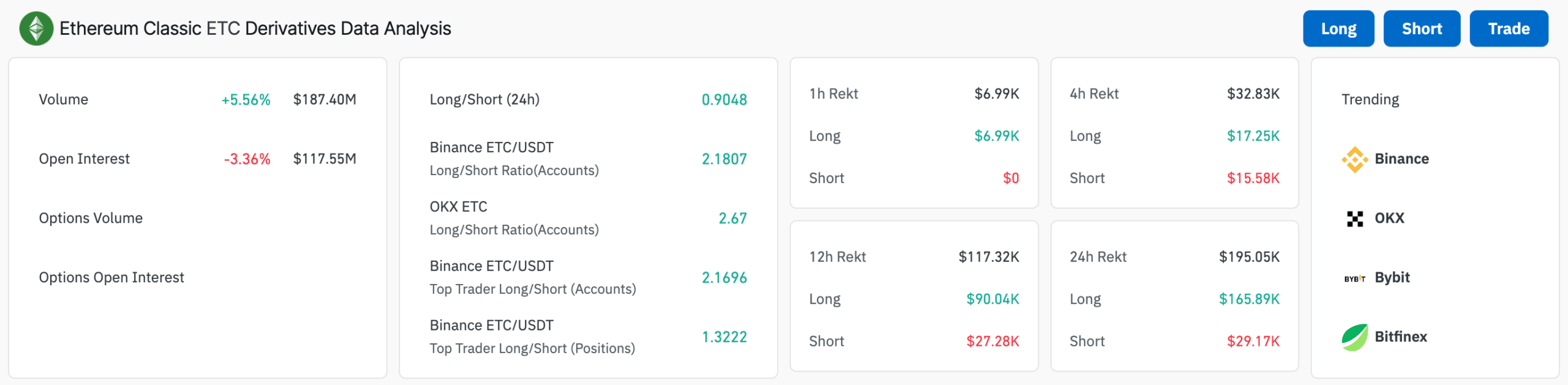

Source: Coinglass

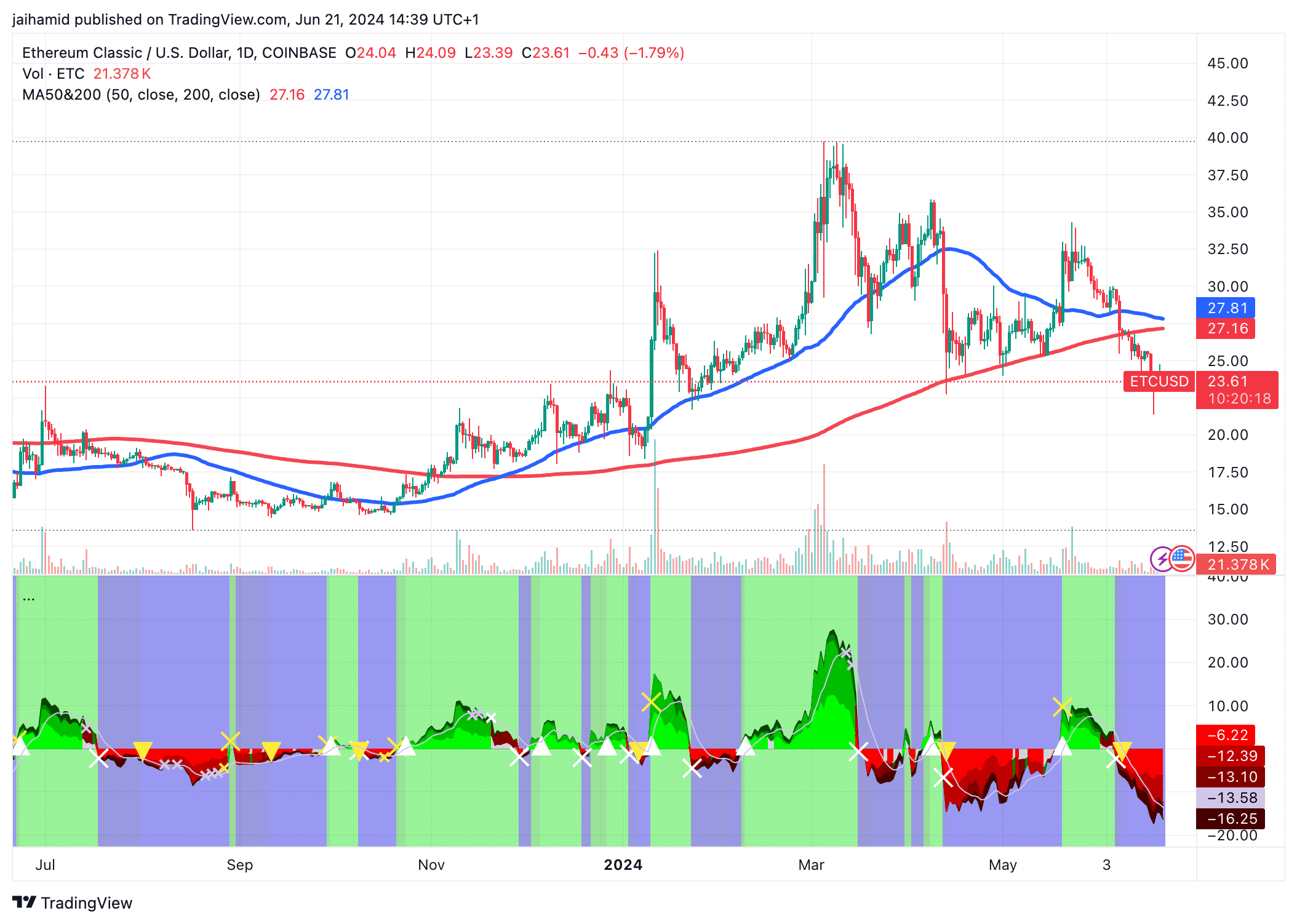

Death Cross alerts extended downtrend

The 50-day transferring common lately crossed under the 200-day transferring common, indicating a bearish ‘death cross.’ This sample usually is an indication of an extended-time period downtrend.

The price peaked at round $35 in March, adopted by a pointy decline. After that, it consolidated across the $30-mark earlier than breaking under the 200-day transferring common.

Source: TradingView

Previous assist ranges may be noticed across the $25-level, which have now been breached and will act as resistances if a price restoration try happens. The subsequent key assist is probably going across the $20-level, which could possibly be examined if the prevailing bearish development continues.

In conclusion, the hike in promoting quantity plus the breach of prior assist ranges tells us that the bears are right here to remain.