Ethereum staking rises, exchange reserves dip: What this means for ETH

- Ethereum’s netflow from exchanges elevated by over 6%.

- ETH has remained under its resistance degree.

Over the previous month, Ethereum [ETH] has skilled a notable development of outflows from exchanges. It indicated that buyers have been transferring their holdings away from buying and selling platforms.

Despite the discount in exchange balances, the amount of ETH being staked has continued to develop. ETH has been endeavoring to stabilize its value amid these shifts in investor habits and community participation.

Ethereum enhance month-to-month outflow

AMBCrypto’s evaluation of Ethereum’s transaction information revealed a big internet outflow from exchanges. The information confirmed that over 1 million ETH moved out of buying and selling platforms in June.

This outflow, valued at roughly $3.8 billion, marked a substantial 6.4% month-over-month change. It indicated a considerable discount within the quantity of Ethereum held on exchanges.

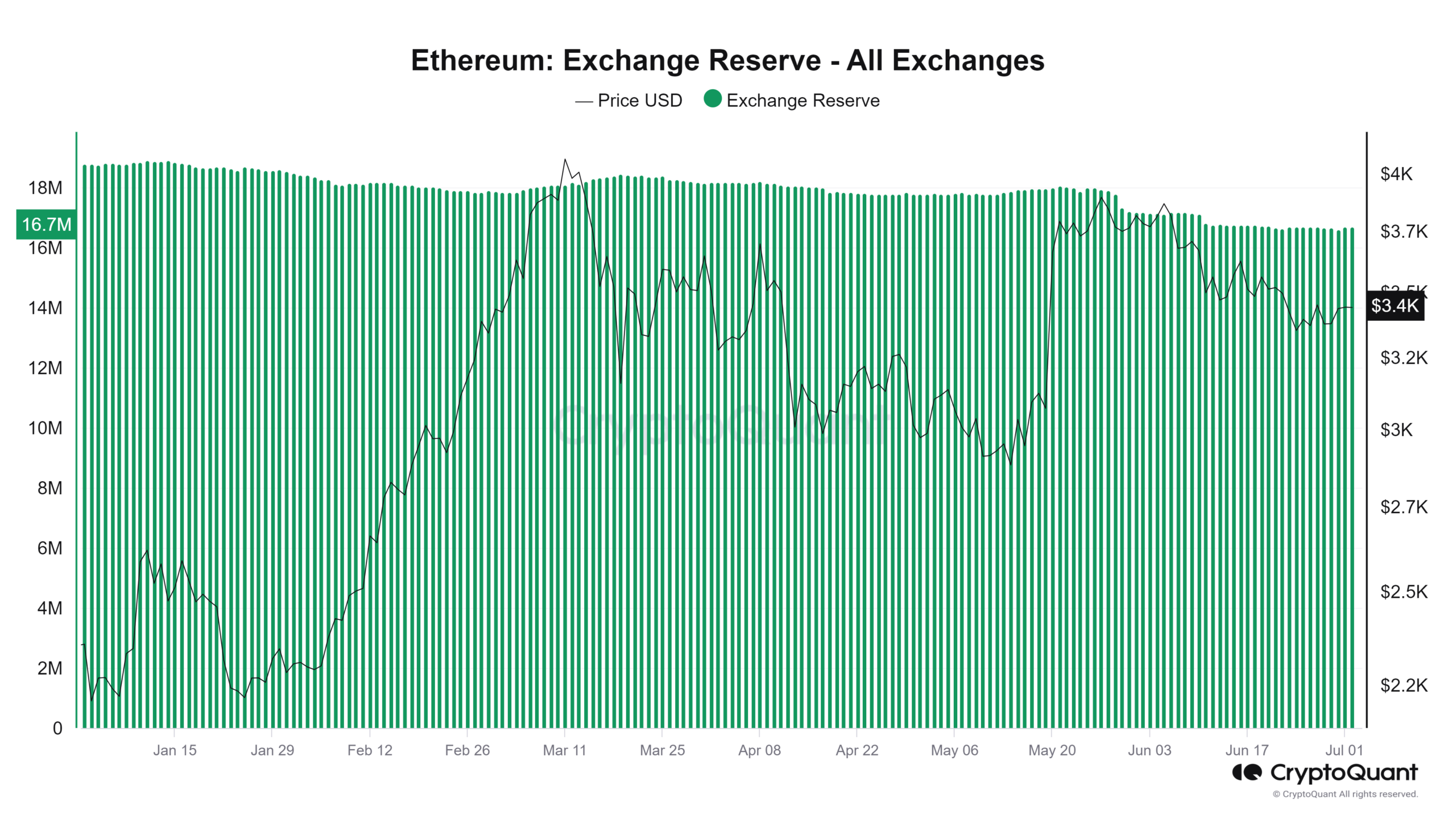

Further examination of the exchange reserve information from CryptoQuant highlighted the magnitude of this shift. At the start of June, the entire ETH held in exchange reserves was over 17 million.

By the tip of the month, this determine had decreased to round 16 million ETH. As of this writing, the reserve was round 16.6 million ETH.

Source: CryptoQuant

This decline in exchange reserves sometimes suggests a few strategic actions by buyers.

It is both a rise in long-term holding, as buyers withdraw ETH to safe wallets, or a transfer to interact extra actively within the Ethereum staking course of.

This is particularly true with the continuing growth in direction of Ethereum 2.0. Both eventualities suggest a bullish sentiment amongst holders.

Total Ethereum staked will increase

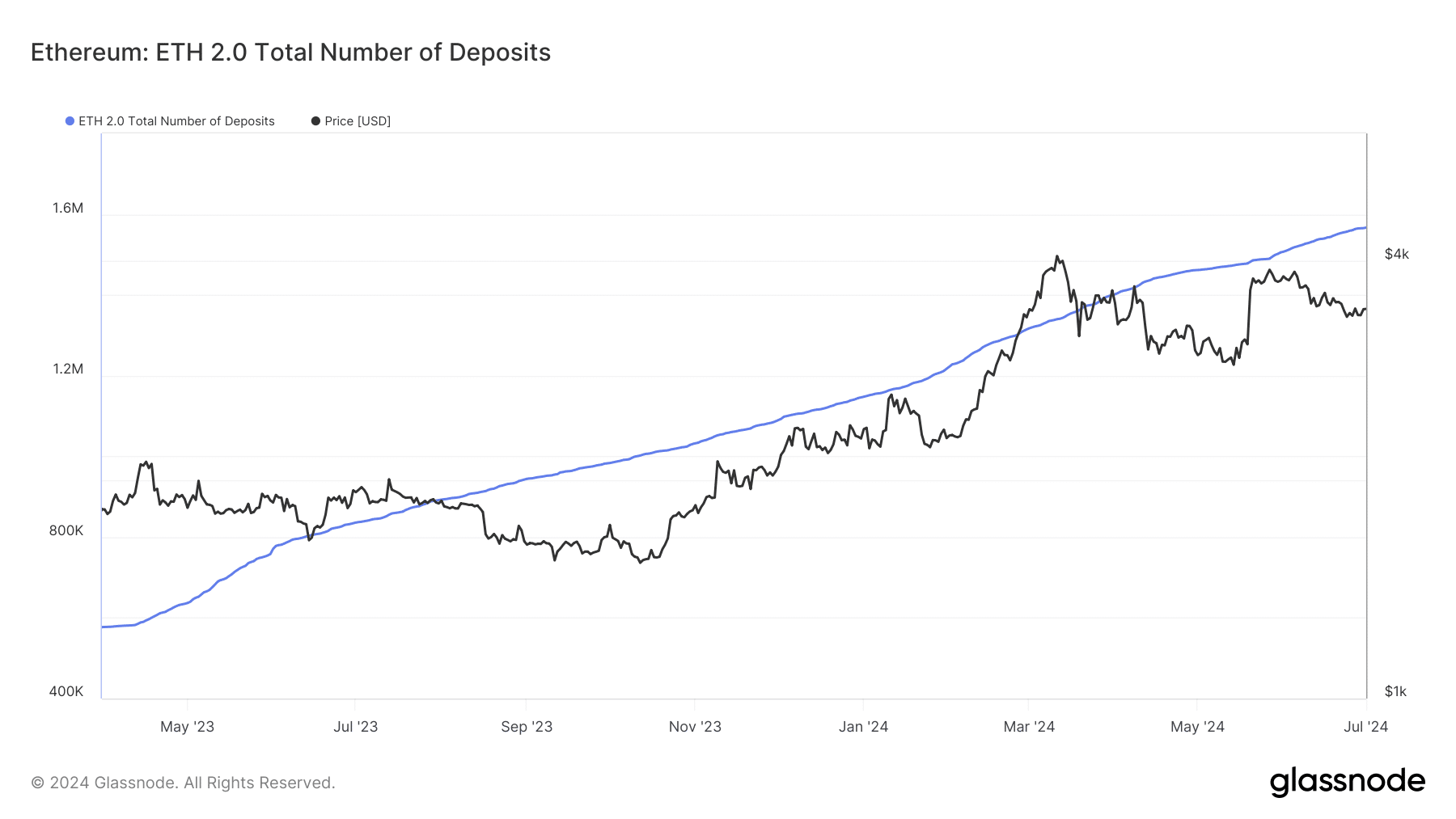

The evaluation of Ethereum’s staking exercise gives insightful developments into the habits of its holders, notably with the reducing balances on exchanges.

According to information from Glassnode, there was a constant enhance within the complete variety of deposits. This indicated that extra holders have been opting to stake their ETH.

This exercise is critical because it suggests a shift from buying and selling or holding Ethereum on exchanges to securing it in staking contracts. According to the most recent information, the variety of deposits has surpassed 1.5 million.

Source: Glassnode

Further reinforcing this development, information from Dune Analytics revealed that over 33.2 million ETH have been staked. This substantial quantity of staked ETH accounts for virtually 28% of the entire ETH provide.

Overall, the elevated staking exercise and the corresponding decline in exchange-held ETH underscore a strategic shift amongst holders towards long-term funding.

ETH discovering resistance

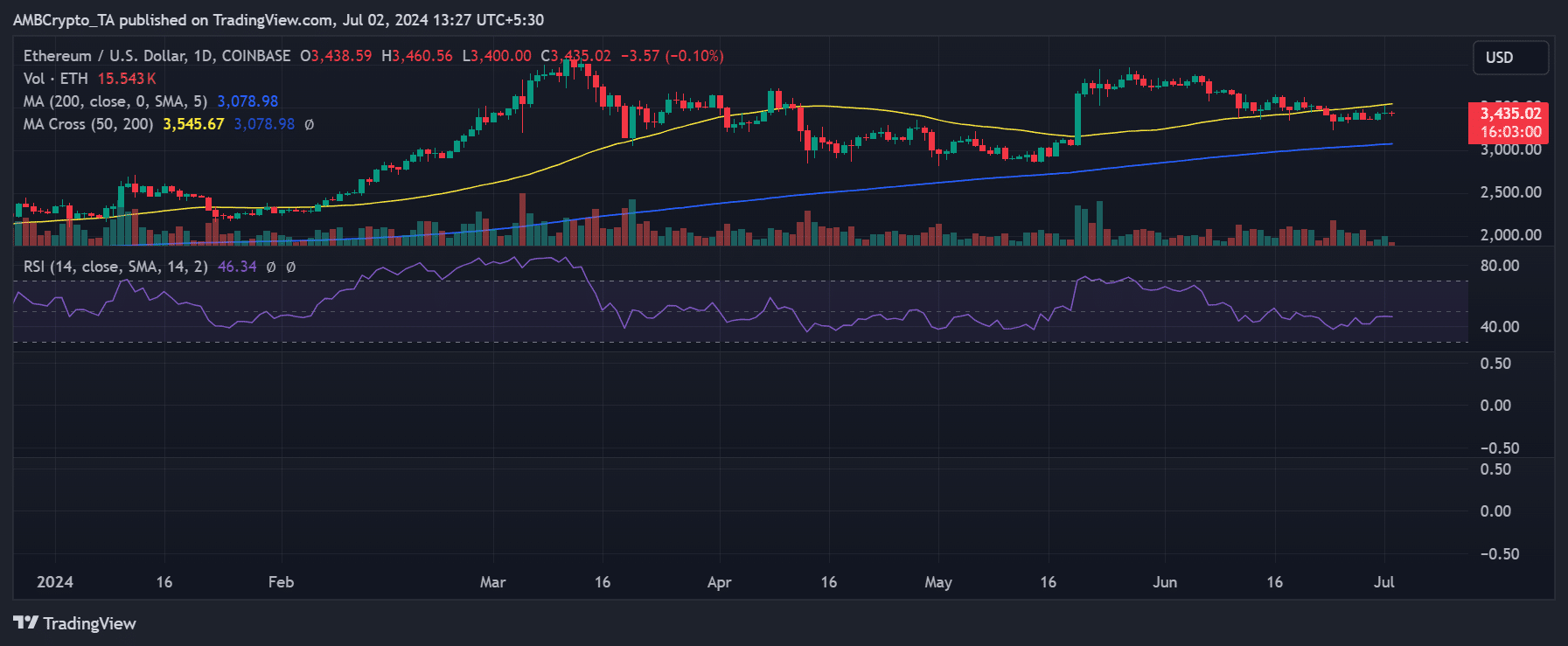

AMBCrypto’s evaluation of Ethereum on a each day timeframe chart indicated a shift in its market dynamics, with the value lately falling under its quick transferring common (yellow line).

This transferring common, which beforehand acted as a assist, is now functioning as a resistance degree because of the current value decline.

This reversal from assist to resistance is a standard technical sample that means a change in market sentiment, the place the value degree that after bolstered shopping for curiosity now poses a barrier to upward actions.

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024-25

As of this writing, Ethereum was buying and selling at round $3,430, experiencing a slight decline of lower than 1%.

The quick resistance outlined by the quick transferring common is at the moment positioned within the vary of $3,500 to $3,600.