European Central Bank holds interest rates at 4% in contested decision

Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales in this weekly e-newsletter.

The European Central Bank despatched a robust sign that it could think about reducing interest rates at its subsequent assembly in June after holding them at all-time highs on Thursday.

The ECB said after its governing council met in Frankfurt that its benchmark deposit price would keep at 4 per cent till rate-setters have been certain value pressures had stabilised.

But its president Christine Lagarde advised reporters {that a} small minority of policymakers had argued for an instantaneous reduce.

In a shift from earlier language, the ECB stated it “would be appropriate” to chop rates if underlying value pressures, its up to date forecasts and the influence of earlier price rises elevated its confidence that inflation was closing in on its 2 per cent goal “in a sustained manner”.

Eurozone inflation has fallen from a 2022 peak of 10.6 per cent to 2.4 per cent in March — tantalisingly near the central financial institution’s purpose.

“What the ECB has done today comes very close to a pre-commitment to cut rates in June,” stated Jörg Krämer, chief economist at Commerzbank in Frankfurt. “It will take a lot of very bad inflation and wage data for them not to do that now.”

Lagarde stated “bumps in the road” may trigger inflation to “fluctuate” over the approaching months earlier than falling to its goal by mid-2025. She stated “recent indicators point to further moderation in wage growth” whereas the general dangers to development “remain tilted to the downside.”

Asked if Thursday’s decision to maintain rates on maintain was unanimous, she stated “a few members felt sufficiently confident” to argue for a reduce. But she added the minority “agreed to rally to the consensus of the very, very large majority of members” who wished to attend at least till June.

Markets initially shrugged off the central financial institution’s assertion. But the euro later slipped 0.3 per cent in opposition to the greenback to $1.0706 whereas the rate-sensitive 2-year German Bund yield — a benchmark for the eurozone — rose 0.02 proportion factors to 2.8 per cent.

Traders in swaps markets barely downgraded the chance that the ECB will start reducing rates in June to round 70 per cent, from 75 per cent earlier in the day.

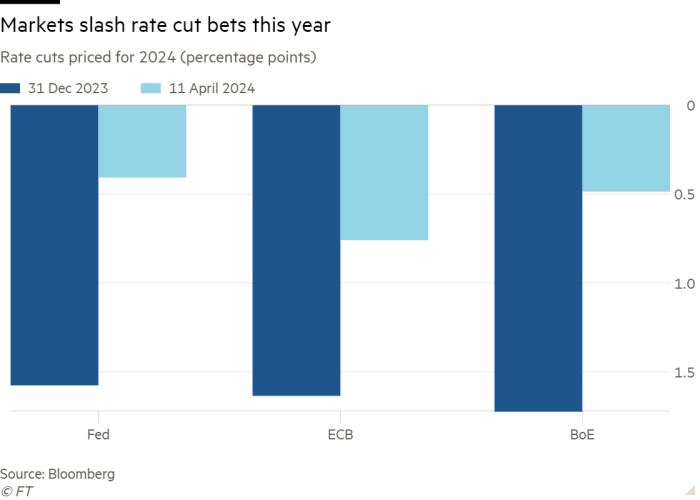

Markets’ rate-cut expectations have been shaken by information this week displaying US inflation rose greater than anticipated in March.

Investors have responded by slashing their bets on Federal Reserve price cuts, to which they now ascribe solely a 50 per cent chance earlier than September. Traders have additionally scaled again their expectations of what number of price cuts the ECB and Bank of England will make this 12 months.

Some eurozone policymakers, as in the UK, might need to keep away from reducing rates way more aggressively than their counterparts in the US, partly out of concern of weakening their currencies and so additional stoking inflation.

But Lagarde pushed again in opposition to the concept that the ECB was not ready to chop rates until the Fed did so too.

“We are data-dependent, not Fed-dependent,” she stated, including that inflation in the US and eurozone have been “not the same” and warning in opposition to drawing conclusions from one for the opposite.

Ann-Katrin Petersen, a strategist at the BlackRock Investment Institute, emphasised that, in contrast with the Fed, “the ECB faces weaker growth and has hiked policy further into restrictive policy”.

She added: “So the ECB will probably cut first, but may then move more slowly if the Fed delays cuts.”

ECB shifts tone from March

April 2024

“ . . . the key ECB interest rates are at levels that are making a substantial contribution to the ongoing disinflation process . . . If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.”

March 2024

“ . . . the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this [2 per cent inflation] goal . . . The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.”