By Morgan Phillips, U.S. Political Reporter For Dailymail.Com

23:06 25 Apr 2023, up to date 23:26 25 Apr 2023

- ‘It’s a socialist redistribution of wealth,’ stated Rep. Warren Davidson in a press release. ‘If the FHFA would not reverse this rule, Congress should’

- A May 1 rule change is supposed to offset low-credit borrowers who extra for his or her mortgages by asking good credit householders to fork over extra cash

- A borrower with good credit might pay round $40 extra monthly on a $400,000 mortgage

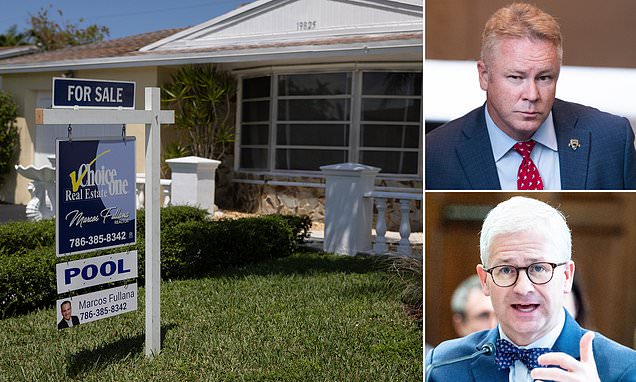

Republican Reps. Patrick McHenry and Warren Davidson despatched a letter on Tuesday promising motion if the Biden administration didn’t reverse modifications that enhance mortgage prices for householders with good credit to offset those that have riskier credit.

Financial Services Chair McHenry, R-N.C., and Housing and Insurance subcommittee chair Davidson, R-Ohio, stated they would transfer to repeal the new provision via laws if the Federal Housing Finance Agency didn’t transfer to achieve this itself.

‘It’s a socialist redistribution of wealth,’ stated Davidson in a press release. ‘If the FHFA would not reverse this rule, Congress should.’

‘These modifications violate the basic precept of risk-based pricing, specifically that lower-risk borrowers ought to pay decrease costs for entry to credit than higher-risk borrowers,’ the 2 chairs wrote of their letter, addressed to FHFA director Sandra Thompson and obtained by DailyMail.com.

‘This new tax additionally fails the essential check of equity by punishing borrowers who act responsibly, and can in flip incentivize homebuyers to cut back their down funds and carry extra debt.’

When a person takes out a mortgage the speed they pay is decided by each rates of interest set by the Federal Reserve and the loan-level worth adjustment. The loan-level worth adjustment capabilities like automobile insurance coverage going up after an accident – the riskier the borrower, i.e. these with dangerous credit, the extra they pay.

A May 1 rule change is supposed to offset low-credit borrowers paying extra for his or her mortgages. They’ll nonetheless pay greater than these with dangerous credit, however lower than they did earlier than.

In order to make up for the misplaced income, borrowers with sturdy credit – 680 and above – might pay round $40 extra monthly on a $400,000 mortgage. Homebuyers who make down funds of 15 to 20 % will likely be hit with the biggest price modifications.

New charges will solely have an effect on those that purchase properties after May 1.

The Federal Housing Finance Agency (FHFA) regulates federal mortgage guarantor giants Fannie Mae and Freddie Mac— which means most individuals who’ve mortgages will likely be affected.

The housing market has already been hit laborious because the Federal Reserve hikes charges to attempt to stave off inflation – mortgage charges have ticked up above 6 %.

FHFA director Sandra Thompson says the foundations change serves to ‘enhance pricing help for buy borrowers restricted by revenue or by wealth.’ She stated the general price modifications would be ‘minimal’ and would guarantee market stability.

The Federal Housing Finance Agency on April 19 proposed a sequence of guidelines modifications centered on ‘Fair Lending, Fair Housing, and Equitable Housing Finance Plans.’ That included including necessities for lenders to tackle the hole in minority homeownership.

In the fourth quarter of 2022 the white homeownership price was 74.5 % whereas black homeownership price was 44.9 %.

Its acknowledged aim for reinforcing homeownership amongst minorities was to generate wealth in these communities.

Lenders depend on credit attributes to decide mortgage accessibility and charges. Black residence mortgage functions are at present denied at the next price than each different ethnic group within the nation.

Neighborhoods with increased black populations additionally see decrease residence costs, FHFA notes.