Solana: A volatile 2 weeks puts SOL’s $200 milestone in question

- SOL maintained its pattern above its 50 MA.

- Derivative metrics flashed constructive indicators.

Over the previous 14 days, Solana’s [SOL] value has skilled vital fluctuations. One week, it seemed to be on the verge of reaching its all-time excessive once more.

The subsequent week, it confronted declines that threatened to push it beneath a crucial threshold.

Solana hops between good points and losses

According to AMBCrypto’s evaluation of the each day timeframe chart, Solana has proven contrasting traits in current weeks.

The value vary device highlighted these fluctuations. Between the 14th and the 20th of May, Solana’s value elevated by roughly 23%, rising from round $141.9 to over $186.

This climb prompt that Solana may reclaim the $200 value zone it reached in March. However, after hitting the $186 mark, the worth reversed.

Source: TradingView

The value vary device indicated that during the last seven days, from the 21st of May to press time, the worth dropped by over 21%.

After spiking to the $180 zone with a 9% improve, it noticed a greater than 4% decline in the subsequent buying and selling session on the 21st of May.

Subsequent declines adopted, and the few uptrends have been inadequate to offset these losses. At the time of writing, Solana was buying and selling round $166, displaying a 1.70% improve.

Notably, it was buying and selling above its quick Moving Average (yellow line), which was performing as assist at roughly $154. However, different key metrics will decide if this present assist stage can maintain.

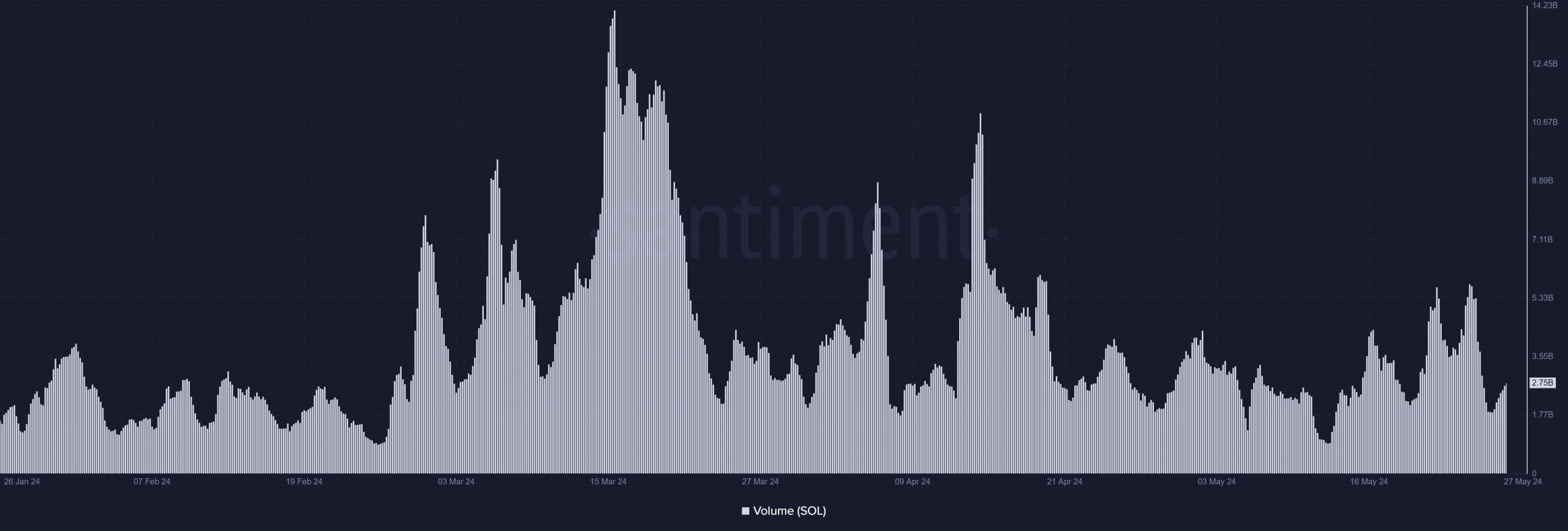

Solana quantity rise above $2 billion

An evaluation of Solana’s buying and selling quantity revealed a big current drop. According to Santiment, the quantity fell from over $5 billion to round $1.8 billion on 25th May.

However, beginning on the 26th of May, the quantity started to rise barely, reaching round $2.5 billion.

At the time of writing, the quantity was over $2.7 billion. This indicated that regardless of the worth decline, Solana was nonetheless experiencing an honest commerce quantity.

Source: Santiment

SOL curiosity and Funding Rate flash constructive indicators

An evaluation of the Funding Rate on Coinglass confirmed a current improve, with the speed at round 0.019% on the time of writing. This signifies that patrons are extra energetic, betting on an increase in Solana’s value.

Additionally, an evaluation of the Open Interest revealed a slight improve, with SOL’s Open Interest at roughly $2.4 billion throughout press time. This inflow of money is a bullish sign.

Considering the buying and selling quantity and spinoff metrics, Solana’s present assist stage may maintain sturdy for some time.

Read Solana’s [SOL] Price Prediction 2024-25

The rising quantity indicated sustained curiosity, and the rise in Open Interest prompt extra cash is flowing into SOL.

This might push the worth greater, and even when it doesn’t, the probability of it falling beneath the present assist stage is low.