What’s behind Ethereum’s bull run? Whales, ETF approval, and…

- Ethereum whales have grow to be extra energetic lately.

- ETH is trying to ascertain the $3,600 vary as its assist.

Analysis revealed that earlier than the Ethereum [ETH] ETF was accredited, a specific whale deal with made daring strikes by buying extra ETH at a particular value stage.

As a outcome, this deal with noticed a big unrealized revenue. Additionally, additional evaluation confirmed an identical sample amongst different whale addresses within the lead-up to the ETF approval.

Whale acquires Ethereum and ecosystem tokens

An evaluation by Lookonchain revealed {that a} explicit whale pockets anticipated the approval of the Ethereum spot ETF and made a considerable buy of ETH.

The information indicated that the whale acquired 8,733 ETH at roughly $3,054.56, totaling round $26.67 million. As a outcome, the whale pockets now holds roughly $6 million in unrealized revenue.

Following the approval of Form 19b-4 by the Securities and Exchange Commission (SEC), the whale proceeded to buy different tokens inside the Ethereum ecosystem, amounting to $24.7 million.

Among these tokens is the Lido DAO [LDO] token, which represents the platform with the best quantity of ETH stakes. The unrealized revenue for these ecosystem tokens within the pockets stands at round $1 million.

Ethereum whale actions enhance

AMBCrypto’s evaluation of Ethereum addresses holding 10,000 or extra ETH revealed a big motion in current days.

According to information from Glassnode, there had been declines within the variety of such addresses earlier than a development reversal across the 19th of May.

The chart illustrated a rise within the variety of addresses from round 997 to roughly 1,006 on the time of writing.

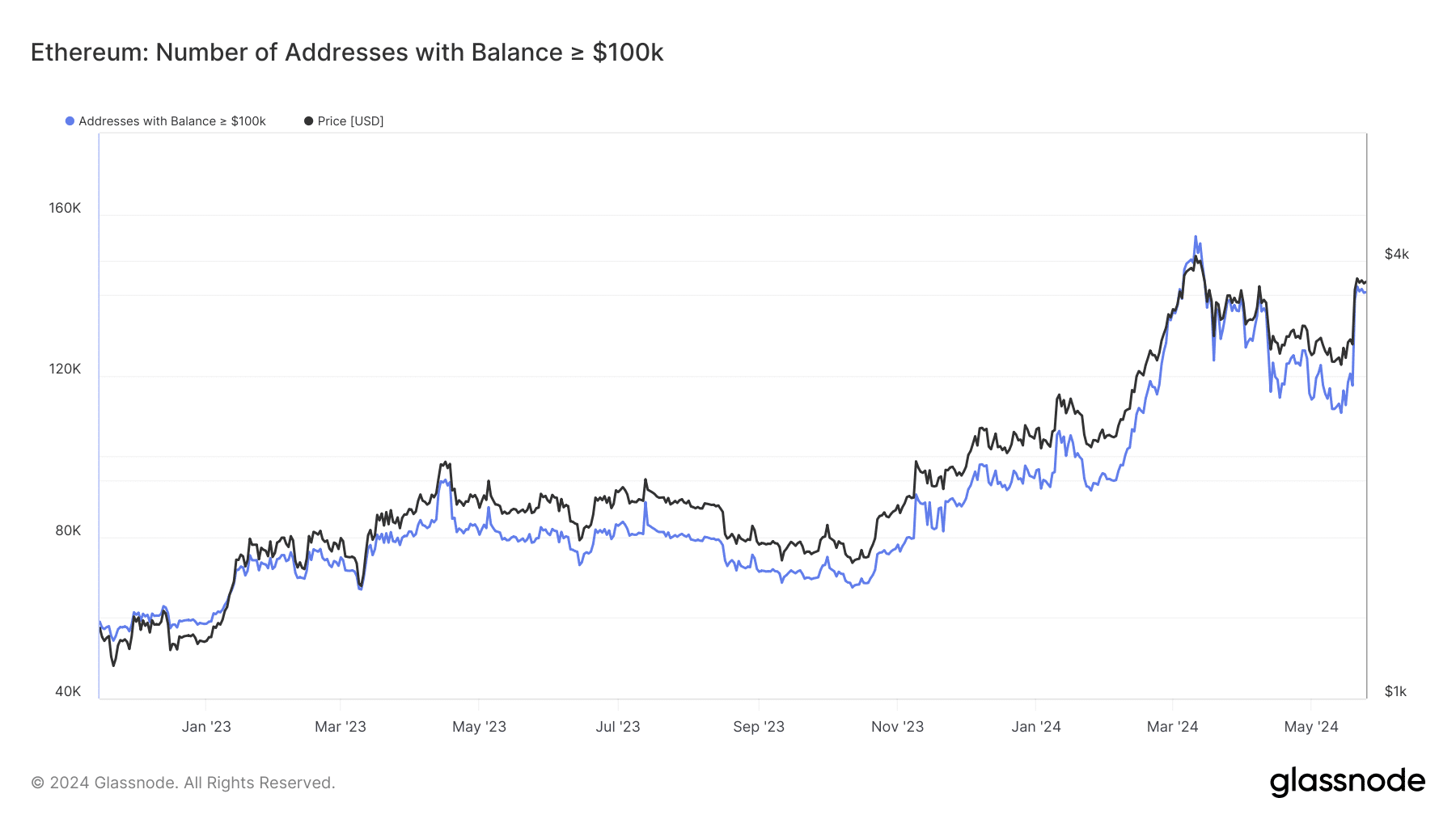

Further examination confirmed that the variety of addresses holding $100,000 or extra price of ETH additionally skilled a notable surge.

In the identical interval, this determine rose from round 117,500 to over 140,000 as of the present writing.

Source: Glassnode

Staked ETH sees a slight decline

AMBCrypto’s take a look at the whole Ethereum staked indicated a quick decline, adopted by an uptick round 20th May.

According to the chart, it elevated to over 32.5 million ETH from round 32.3 million ETH throughout this era. As of press time, the whole ETH staked stood at round 32.56 million, with a slight decline noticed.

Also, the present staked quantity represented roughly 27.1% of the whole Ethereum provide.

Ethereum maintains a bull run

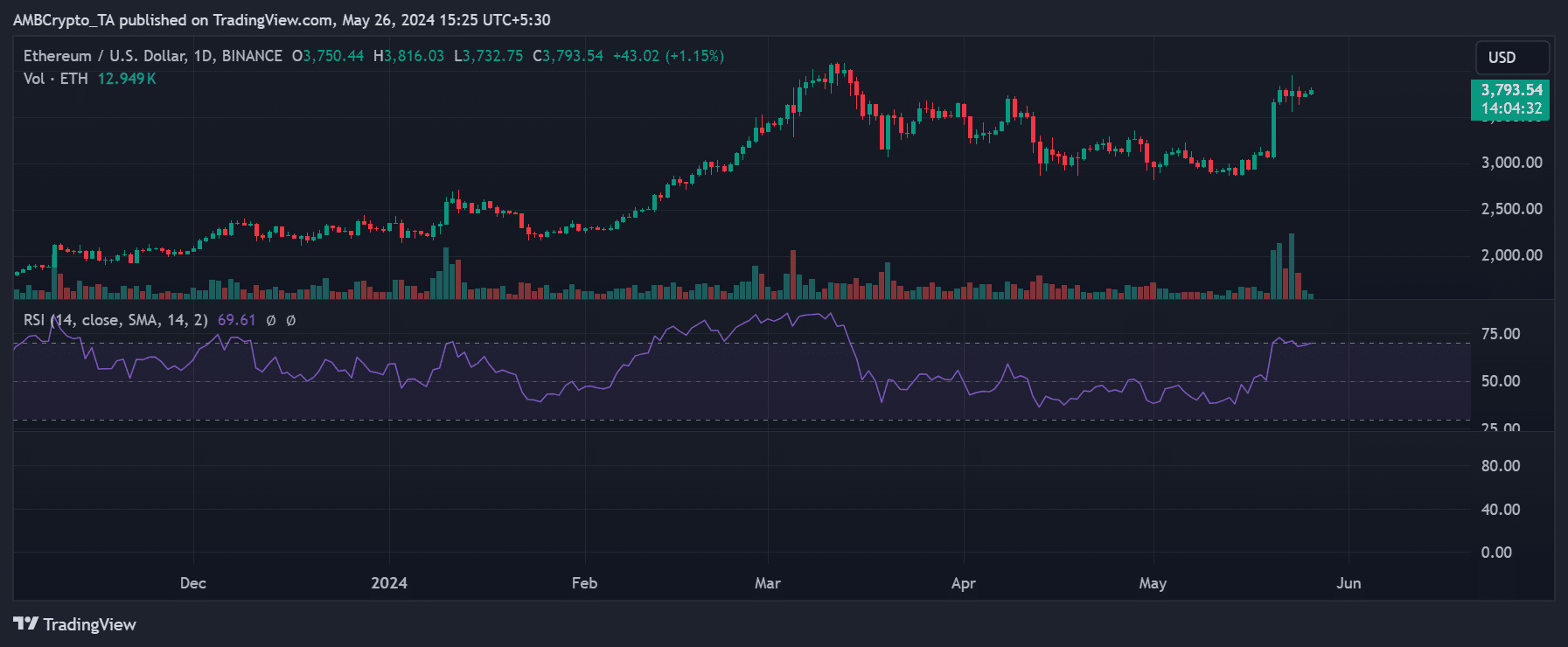

As of press time, Ethereum was buying and selling at roughly $3,790, reflecting a rise of over 1%. Analysis of the day by day time-frame chart indicated its efforts to maintain the $3,700 value vary because it rose to that stage.

Read Ethereum’s [ETH] Price Prediction 2024-25

The present development steered Ethereum’s try to ascertain the $3,600 vary as its assist.

Source: TradingView

The Relative Strength Index (RSI) confirmed Ethereum barely under the overbought zone. This steered a robust bullish development but in addition implied the potential for a decline, even amidst one other potential bull run.