Will Ethereum surge to $4.5k before ETH ETFs go live?

- Ethereum’s value nears $4,000, influenced by optimism round newly accredited ETFs.

- Market analysts counsel the potential for Ethereum to attain as excessive as $10,000 within the present cycle.

In the wake of the U.S. Securities and Exchange Commission (SEC) approving purposes for Ethereum [ETH]-based Exchange Traded Funds (ETFs), the king of altcoins has showcased a vigorous uptick.

Starting the week on a powerful word, Ethereum recorded a 3.7% enhance within the final 24 hours, pushing its value close to the numerous $4,000 mark, a substantial rise from current weeks.

At press time, Ethereum traded at $3,899, marking a major rebound from earlier fluctuations.

Ethereum faces potential $4,500 goal

Amid this value motion from Ethereum, Arthur Cheong, CEO of DeFiance Capital, suggested that Ethereum may attain $4,500 before the buying and selling of its spot ETFs commences, probably in July or August.

Cheong drew parallels to the 2017 crypto increase, indicating that the introduction of spot Ethereum ETFs might appeal to a considerable retail investor base.

This is very similar to its Bitcoin [BTC] counterparts, that are seeing over 70% of positions held by retail buyers.

The enthusiasm round Ethereum’s future efficiency is palpable amongst buyers and market spectators.

However, it’s essential to word that these projections stay speculative, with the precise market trajectory depending on quite a few elements together with broader financial circumstances and investor sentiment.

Moreover, the SEC’s present regulatory panorama exhibits a inexperienced mild just for the preliminary 19b-4 requests for Ethereum ETFs, with the important S-1 kinds nonetheless awaiting approval.

Ethereum’s bullish tendencies

Despite these regulatory hurdles, Ethereum’s market dynamics have proven strong progress, not solely in value but in addition in basic on-chain metrics.

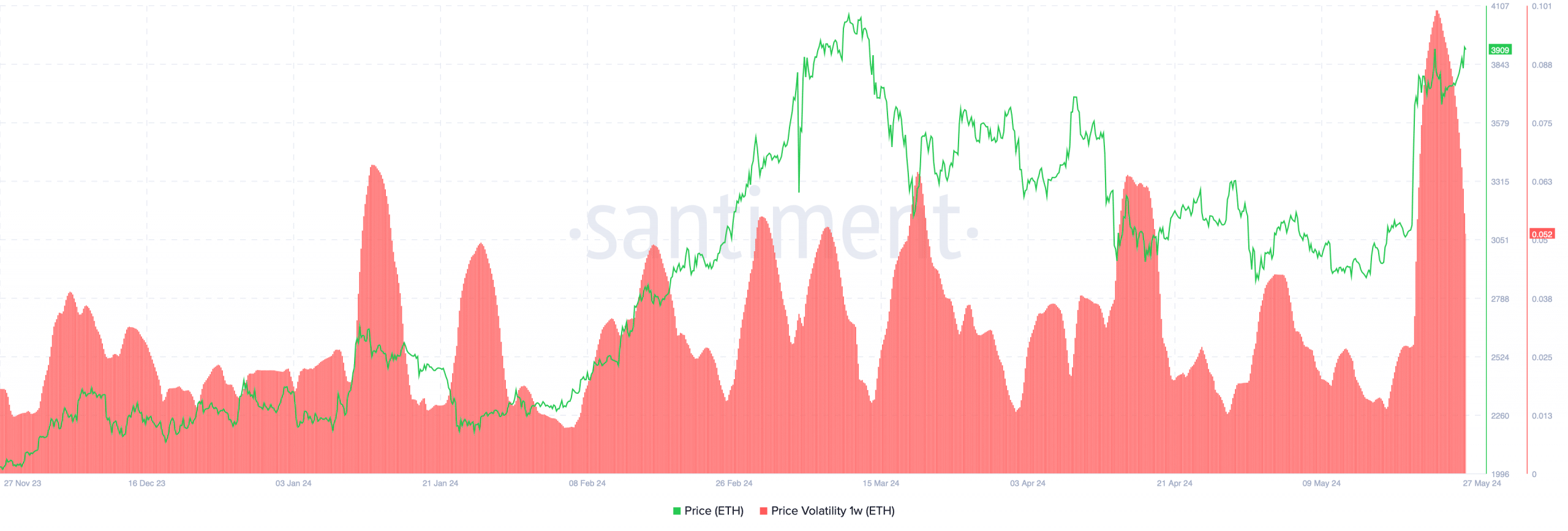

Data from Santiment highlighted a surge in Ethereum’s value volatility, a metric that has considerably elevated from its low previously fortnight to a notable peak at the moment.

Source: Santiment

Notably, because the cryptocurrency’s value volatility is rising together with its value, this means a interval of heightened buying and selling exercise and curiosity, usually pushed by speculative shopping for.

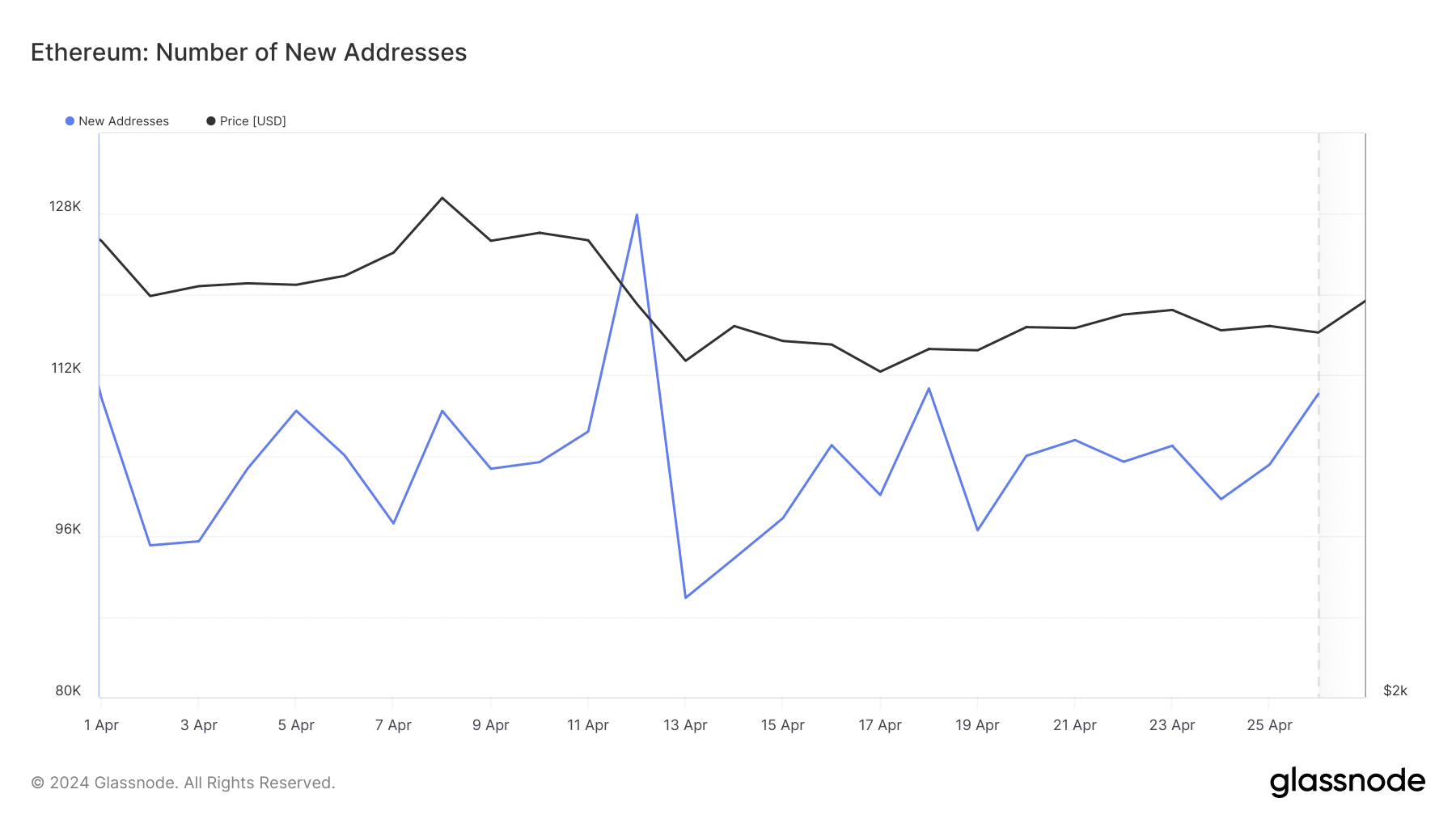

Adding to the rising curiosity, Glassnode reported an uptick within the variety of new Ethereum addresses, suggesting an increasing community of customers.

Such an increase usually signifies elevated market participation, probably buoyed by the optimistic market sentiment and broader adoption.

Source: Glassnode

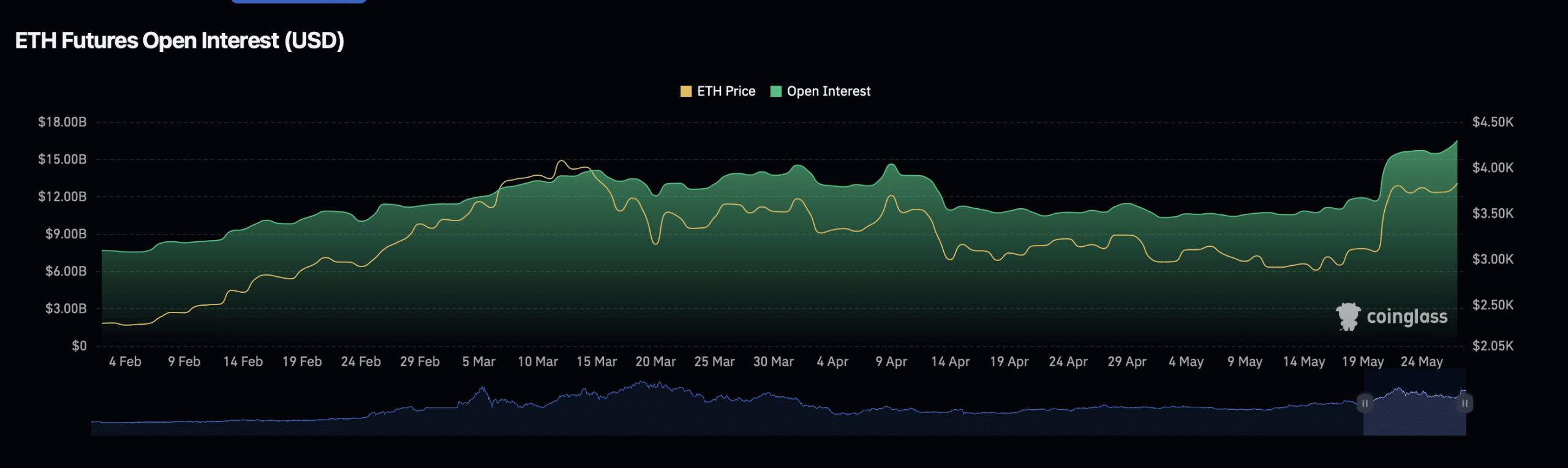

Moreover, Coinglass’ data revealed a spike in Ethereum’s Open Interest, underscoring an lively derivatives market with heightened buying and selling volumes.

This not solely pointed to elevated liquidity, but in addition to a rising speculative curiosity the place merchants anticipate forthcoming value actions.

Source: Coinglass

Nonetheless, a rise in Open Interest additionally implies larger market leverage, which might amplify each positive aspects and losses, relying on market instructions.

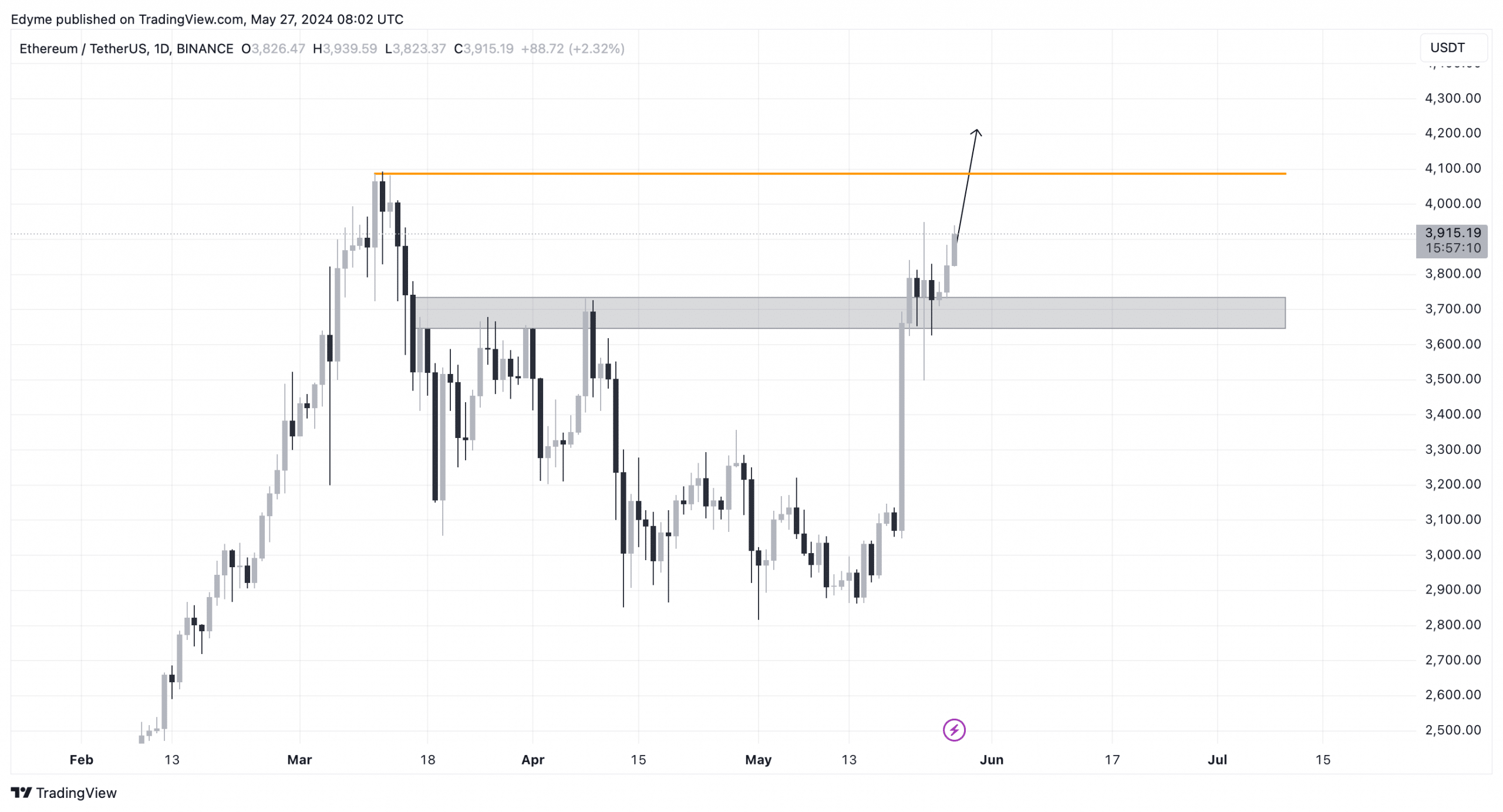

Technical evaluation of Ethereum’s day by day chart revealed that the cryptocurrency has not too long ago breached the $3,700 resistance degree flipping it to help, setting its sights on the subsequent vital milestone at $4,000.

This breakthrough means that bullish momentum is robust, probably driving additional positive aspects.

Source: TradingView

Is your portfolio inexperienced? Check out the ETH Profit Calculator

Concurrently, AMBCrypto, citing information from Glassnode, reported a vital lower in Ethereum’s Network Value to Transaction (NVT) ratio.

A discount on this ratio means that the asset is at present undervalued, which can point out an impending rise in its market value.