How does Ethereum’s price prediction look after SEC’s ETF approval?

- ETH’s provide on exchanges hiked over the previous few days

- A metric revealed that ETH was undervalued, hinting at a price uptick on the charts

It has been solely two days because the much-anticipated spot Ethereum [ETH] ETFs had been accepted by the U.S Securities and Exchange Commission (SEC). However, the end result of this approval didn’t become as anticipated, with ETH quickly turning bearish on the charts. Hence, it’s price taking a better look at what’s happening.

Ethereum ETF approval goes fallacious

AMBCrypto reported beforehand that the usSEC accepted eight purposes for spot Ethereum [ETH] exchange-traded funds (ETFs) on 23 May. The regulator accepted 19b-4 varieties for the ETF purposes filed by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

Now, though many anticipated ETH’s price to increase after that, the other occurred. According to CoinMarketCap, ETH’s week-long bull rally got here to an finish as its price dropped by virtually 2% within the final 24 hours. At press time, it was buying and selling at $3,766.04 with a market capitalization of over $452 billion.

Ali, a preferred crypto-analyst, just lately shared a tweet stating that there have been fairly a couple of doable causes behind this bearish price motion. As per the identical, ETH registered a big sell-off quickly after the approval, one which may have been a profit-taking transfer by buyers. For occasion, Jeffrey Wilke, one of many co-founders of Ethereum, transferred 10,000 ETH, price round $37.38 million.

Additionally, the king of altcoins’ provide on exchanges additionally spiked, additional establishing the truth that promoting stress on the token has been excessive. Apart from this, a key indicator, TD sequential, additionally flashed a promote sign on ETH’s price chart.

However, the bearish price pattern may change below one situation. According to Ali, ETH has a resistance stage between $3,940 and $4,054. As per the tweet, if ETH manages to report a day by day candlestick and shut above $4,170, the bearish pattern may come to an finish.

Are bears prepared to let go?

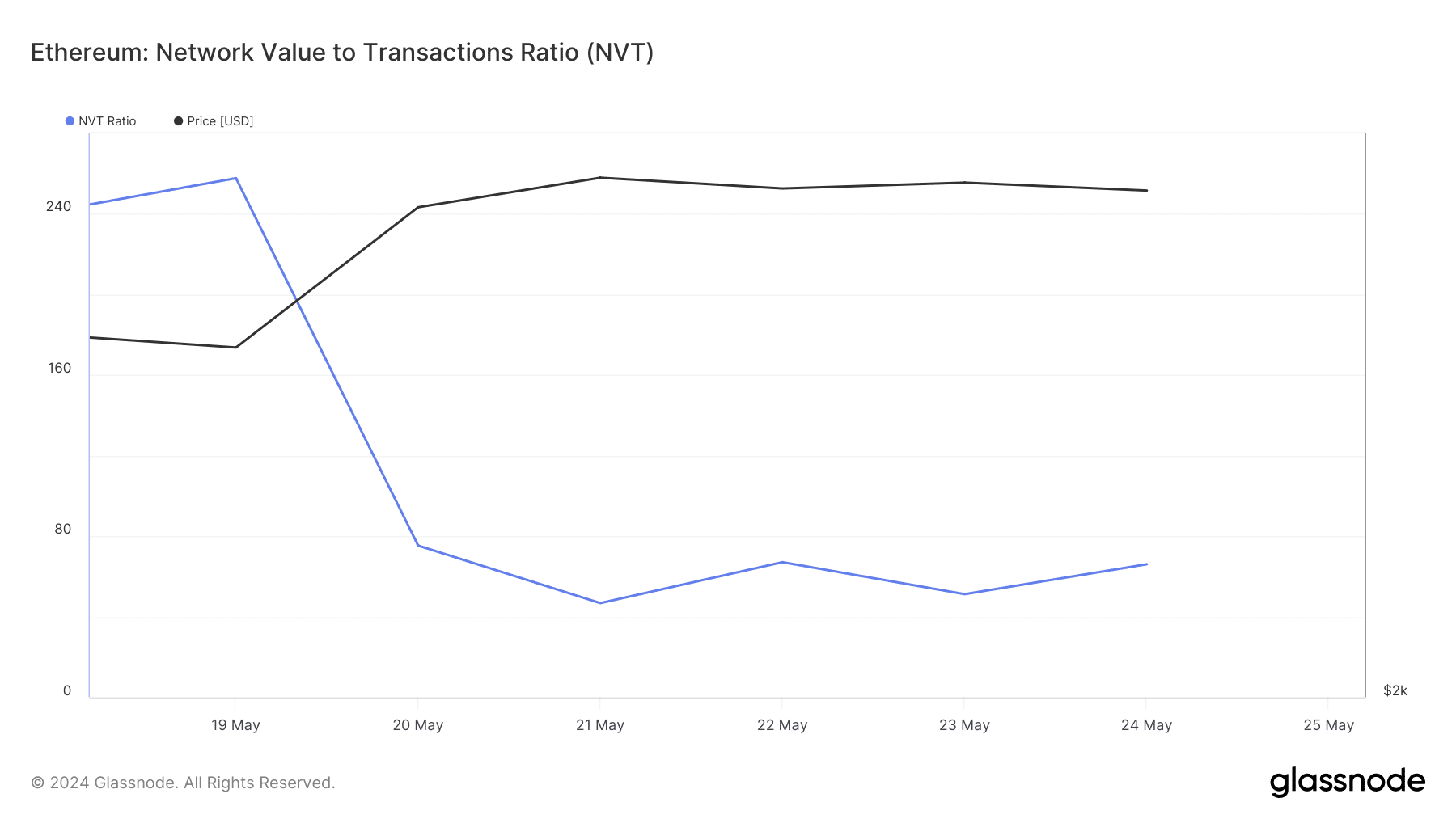

AMBCrypto then analyzed ETH’s on-chain metrics to see whether or not they assist the potential for ETH going above the aforementioned resistance zone. As per our evaluation of Glassnode’s knowledge, ETH’s NVT ratio registered a pointy decline. A drop within the metric implies that an asset is undervalued, hinting at a price uptick on the charts.

Source: Glassnode

However, ETH’s fear and greed index had a worth of 67% at press time, that means that the market was in a “greed” section. Whenever the metric reaches that stage, it signifies that the probabilities of a price correction are excessive. To higher perceive what to anticipate, AMBCrypto then checked Ethereum’s day by day chart.

Is your portfolio inexperienced? Check out the ETH Profit Calculator

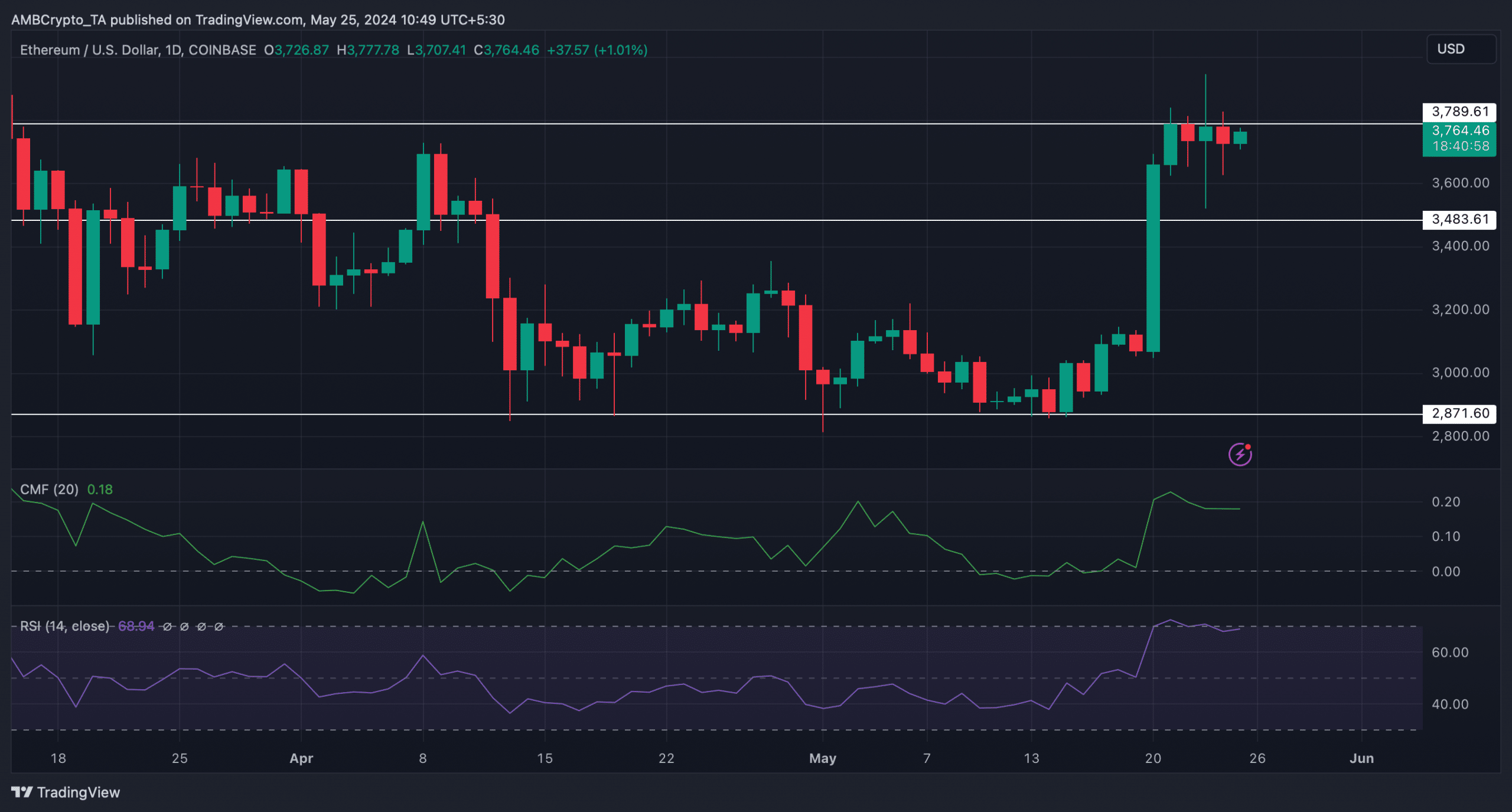

We discovered that ETH’s Chaikin Money Flow (CMF) took a sideways route over the previous few days. An analogous pattern was additionally famous by the Relative Strength Index’s (RSI) chart.

These indicators prompt that buyers may witness a couple of extra slow-moving days.

Source: TradingView