VanEck’s SOL ETF application sends Solana flying: New ATH ahead?

- SOL rallied 9% and hit $150 following VanEck’s SOL ETF application

- A market maker has since gone lengthy on SOL, projecting its value might recognize 8.9x.

The first US spot Solana [SOL] ETF application on 27th June by asset supervisor VanEck boosted crowd optimism on the SOL token. It rallied 9.4% through the intraday buying and selling session on the identical day.

However, in contrast to Bitcoin [BTC] and Ethereum [ETH], SOL doesn’t have a product based mostly on future ETFs, which might have an effect on the SEC’s approval.

But Bloomberg senior ETF analyst Eric Balchunas noted that issues might change with a brand new administration.

‘If change at POTUS, I think anything possible…I see this filing as a call option on the POTUS election. Because the election happens but the 240 days the SEC has to ponder.’

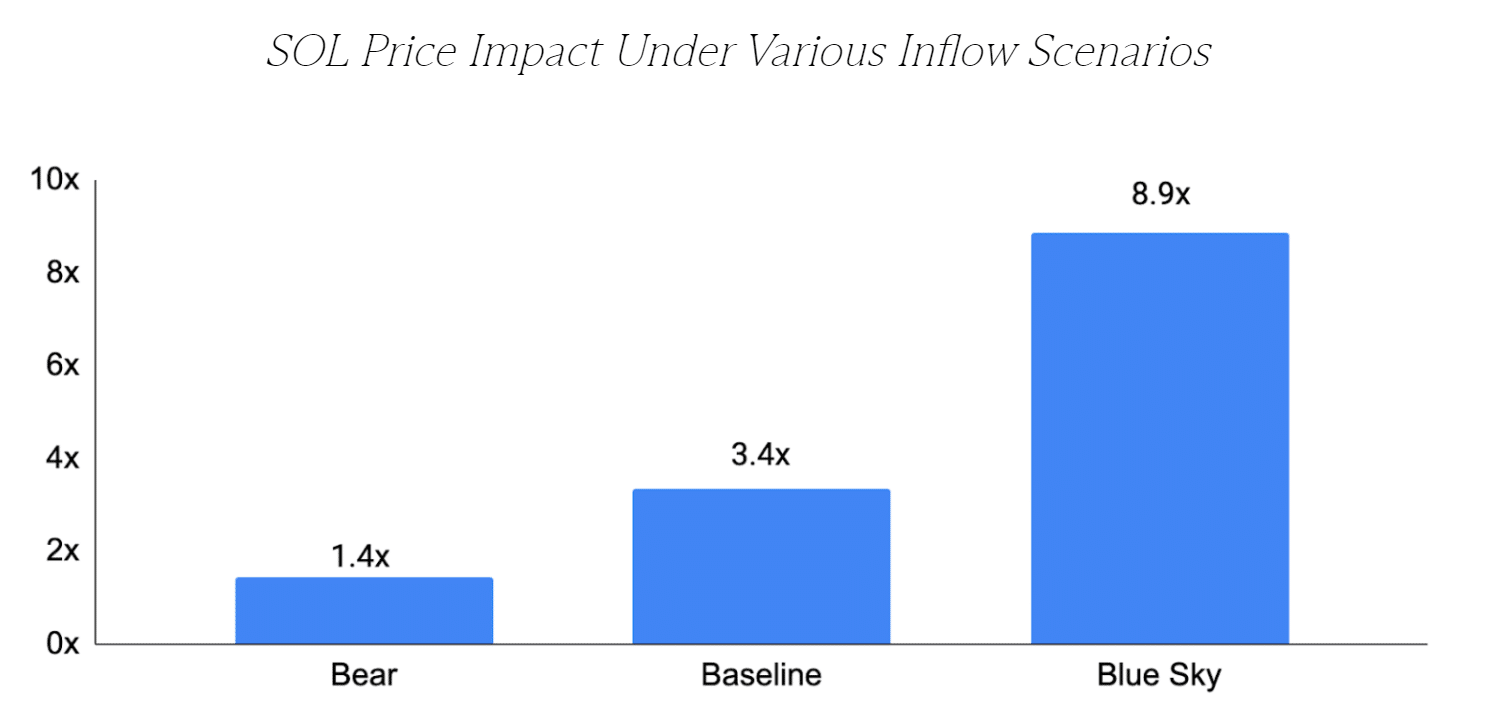

SOL ETF to drive value 8.9x?

Balchunas’s sentiment was echoed by one other coverage watcher, Scott Johnsson, a finance lawyer at Van Burien Capital. Johnsson added that Solana ETF may very well be authorised with out having the futures ETF like BTC and ETH did.

‘This SEC (and any led by another chair) is going to change the rules again when it’s politically expedient.”

Given the conviction that Solana ETF may very well be a matter of ‘when’ not ‘if’, crypto market maker GSR has gone ‘long on SOL.’ In a latest replace, GSR noted,

‘And with the others having or on the cusp of a spot ETF, not only is it likely just a matter of time before Solana gets one too, but also the impact on SOL just might be the largest yet…GSR is long SOL.’

GSR estimated that the ETF might appeal to 2%- 14% of BTC ETF flows. Per the market maker, if SOL ETF attracts 14% of BTC flows, SOL’s value might rally 8.9X in a bullish case state of affairs (Blue Sky).

Source: GSR Markets

What’s subsequent for SOL?

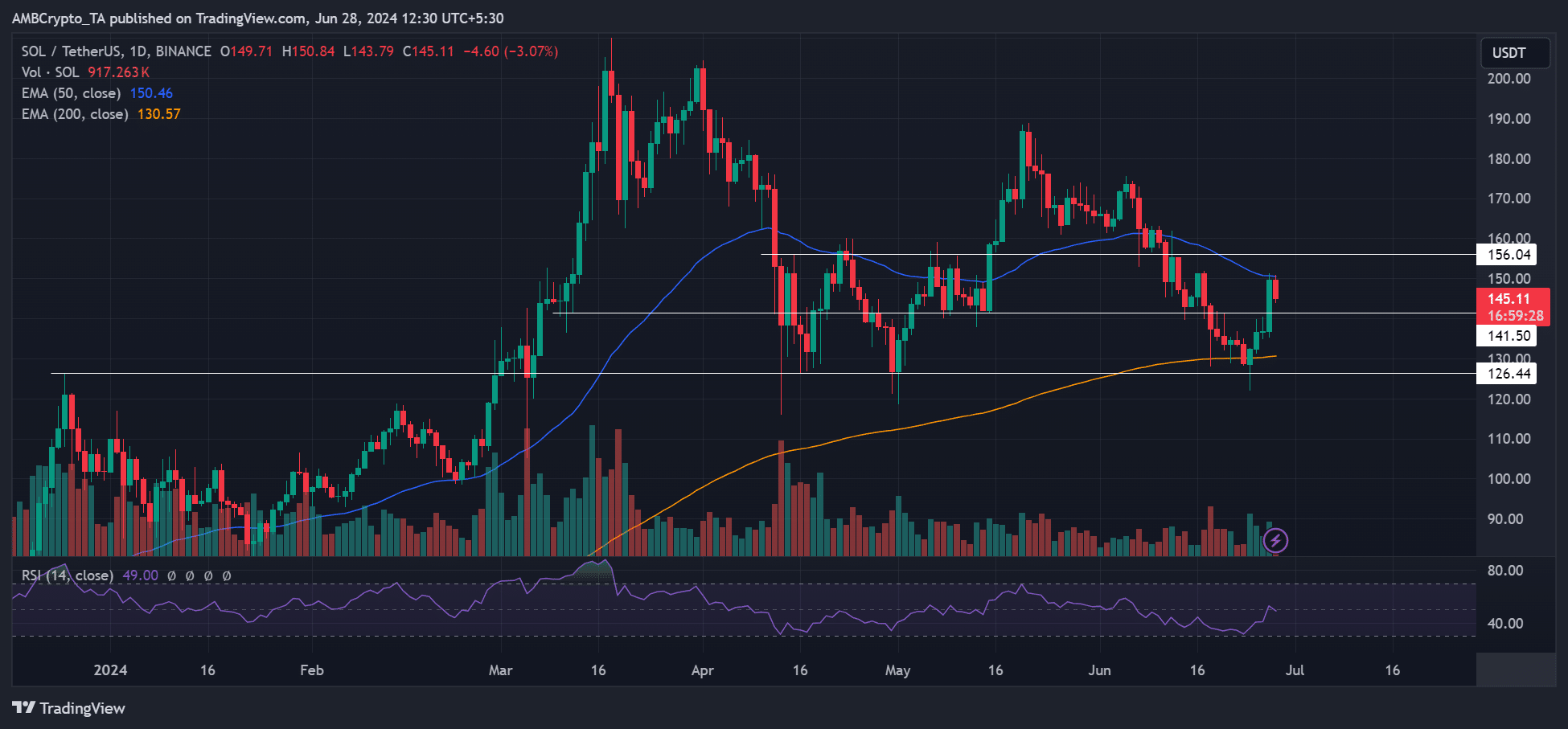

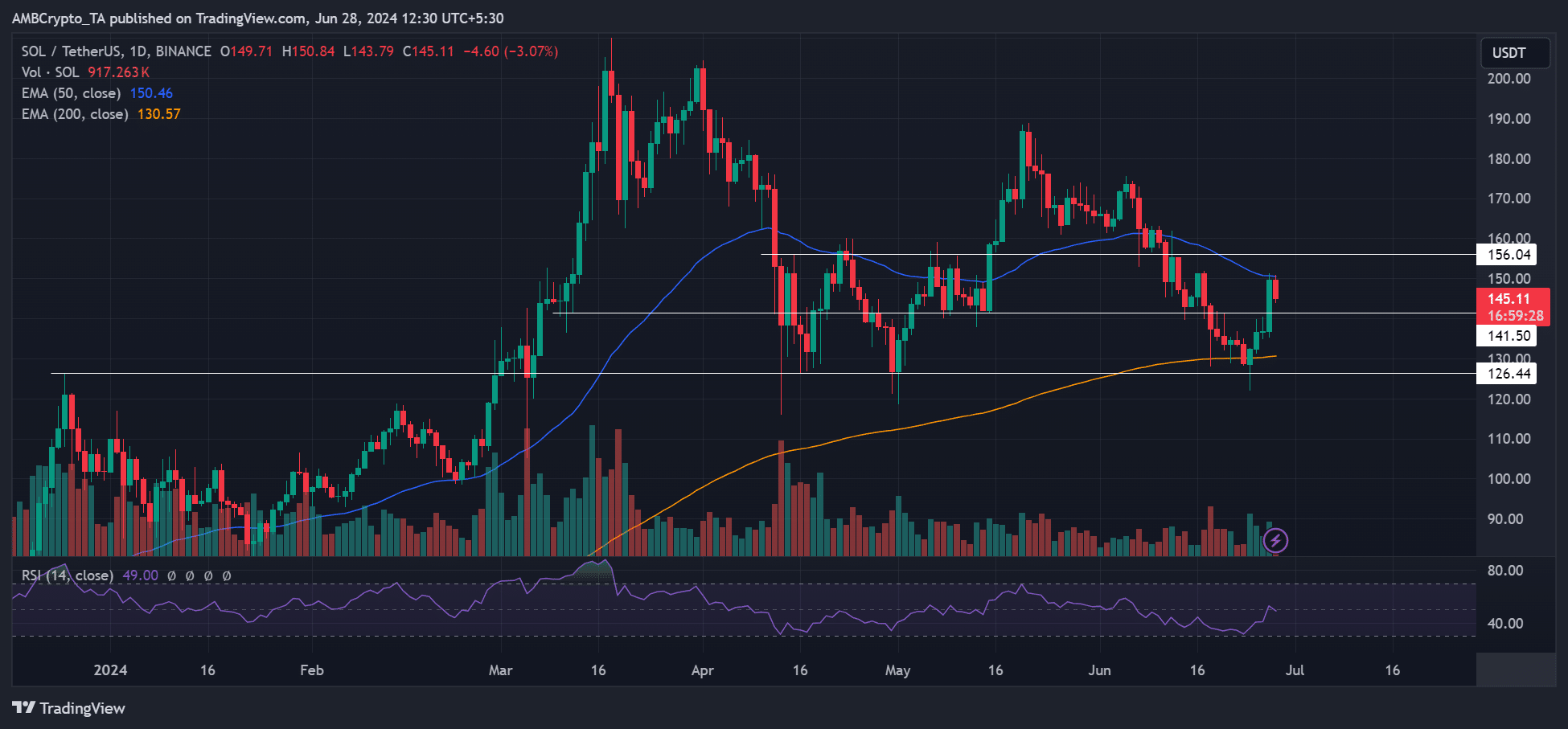

In the meantime, the Thursday upswing noticed SOL hit $150. However, it additionally reached the 50-day EMA (Exponential Moving Average), which may very well be a key resistance stage if the group optimism wanes.

Source: SOL/USDT, TradingView

As of press time, SOL had erased a part of Thursday’s features and traded at $145. Santiment, a blockchain intelligence information platform, had beforehand noted that SOL’s correction was possible after the SOL ETF information.

‘SOL’s rally is being accompanied by merchants FOMO’ing in, which means the rally is much less prone to proceed.’